Wise has become a trusted choice for over 12.8 million people worldwide, offering fast and transparent international money transfers.

Its cost-effective transfer service claims to be up to five times cheaper than alternative providers and is used by both personal and business customers.

In this Wise money transfer review, I’ll look at the pros and cons of using the service to help you decide if it’s the best way to send money from the UK.

- Should You Use Wise?

- Wise Money Transfers At A Glance

- Wise International Transfer Pros and Cons

- Who Are Wise Transfers Best For?

- Wise Money Transfer Key Features

- How Much Does It Cost To Use Wise

- What’s The Transfer Process Like?

- Customer Support

- Wise Customer Reviews

- Is Wise Safe For Transferring Money?

- Wise Recent Updates and Recognitions

- Disclaimer

Send Money Smarter With Currency Expert

Should You Use Wise?

If you’re looking for a secure, cost-effective way to send money abroad, I think Wise is one of the strongest options available—especially if you value low fees, real exchange rates, and full transparency. But what really stands out to me is how seriously Wise takes security.

Wise is fully regulated in the UK by the Financial Conduct Authority (FCA) and globally by over a dozen financial watchdogs. Your money is safeguarded in dedicated accounts at top-tier institutions, so it’s never mixed with company funds. Two-factor authentication (2FA), device recognition, and robust encryption help protect your account from unauthorised access. That level of protection offers real peace of mind, particularly when transferring large amounts.

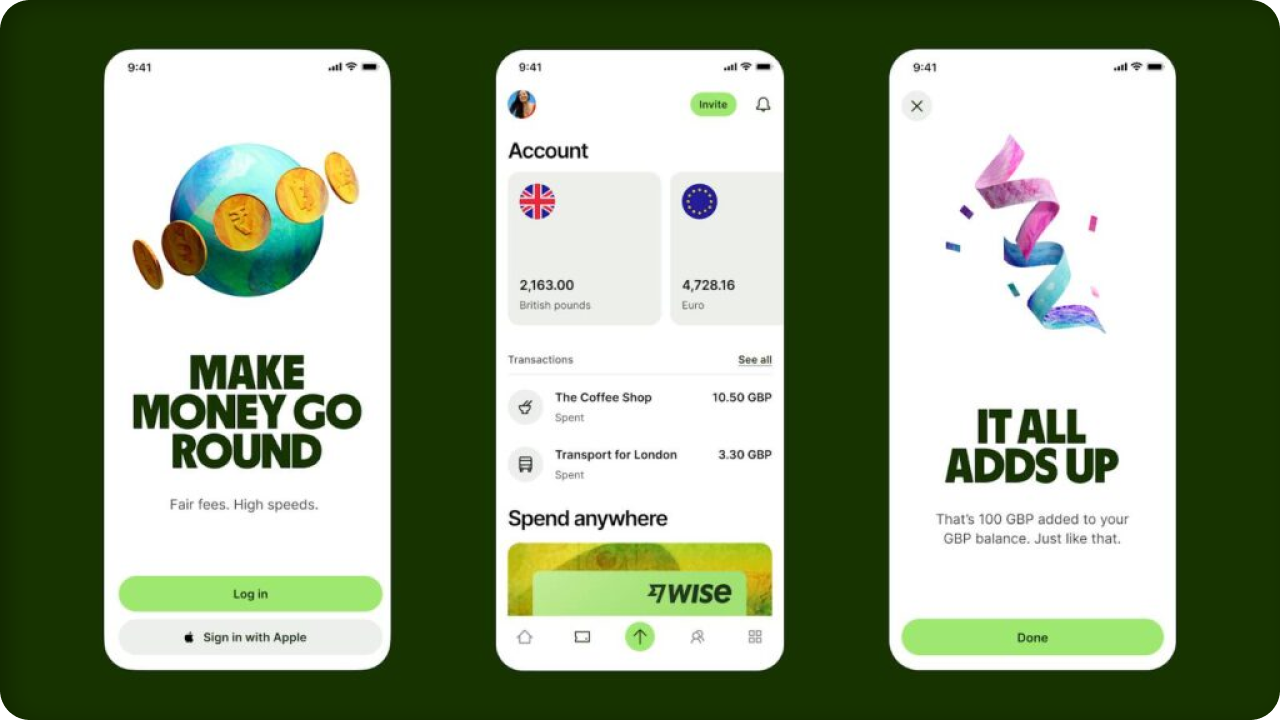

The app’s intuitive design, real-time tracking, and multi-currency account make it incredibly convenient for everyday use, especially for digital-first users. I think it’s especially useful for expats, international freelancers, and small businesses managing payments in different currencies.

That said, it’s not perfect. There’s no cash pickup service, and customer support can be slow if something goes wrong. A few users have reported issues with frozen accounts or delays during identity checks. I’d still trust it for most transfers, but I’d advise keeping transfers well-documented and verifying details upfront.

If security, transparency, and fair pricing matter most to you, and you’re comfortable managing things online, Wise is an excellent choice.

Wise Money Transfers At A Glance

| Feature | Details |

|---|---|

| Best For | Transparent, low-cost transfers; managing multiple currencies |

| Not Ideal For | Cash pickups, poor internet access, or those needing extensive phone support |

| Trustpilot Rating | 4.3 out of 5 (250,000+ reviews) – praised for low fees and speed |

| App Ratings | 4.8/5 on Apple App Store & Google Play – clean design, user-friendly |

| Transfer Speed | Often instant or same-day (depends on currency/country) |

| Transfer Fees | Low, variable fees based on amount, route, and payment method |

| Exchange Rates | Mid-market rate with no markup – what you see is what you get |

| Supported Currencies | 40+ currencies, 160+ countries |

| Payment Methods | Bank transfer, debit card, credit card, Apple/Google Pay (varies by region) |

| Transfer Types | Personal and business payments, one-off or recurring |

| Account Features | Multi-currency account, virtual card, spend & hold in multiple currencies |

| Customer Support | Live chat & email – generally helpful, but can be slow at peak times |

| Regulation & Safety | FCA-regulated in the UK, uses bank-level encryption and two-factor login |

Wise International Transfer Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Transparent, real-time exchange rates | No cash pickup services |

| User-friendly interface and mobile app | Limited customer support availability |

| Fast transfer speeds for certain transactions | Card payments can incur higher fees |

| Low fees fro small transfers | No dedicated account manager |

| Large transaction discounts | Receiving USD via SWIFT incurs a fee |

| Local account details in major currencies |

Who Are Wise Transfers Best For?

Best suited to:

- People sending regular payments abroad (e.g. freelancers, expats, remote workers)

- Businesses paying international suppliers or receiving global payments

- Travellers and digital nomads managing multiple currencies

- Anyone wanting transparent fees and real mid-market exchange rates

- Users comfortable managing everything online or via an app

Least suited to:

- Those needing cash pick-up or in-person services

- Users making very large transfers who want a dedicated account manager

- People transferring to less common currencies, where speeds may vary

- Anyone who prefers phone-based support or hand-holding for complex transfers

- Senders looking for same-day delivery in every country – it’s fast, but not instant everywhere

Wise Money Transfer Key Features

Here is a detailed overview of Wise’s main features for transferring money internationally.

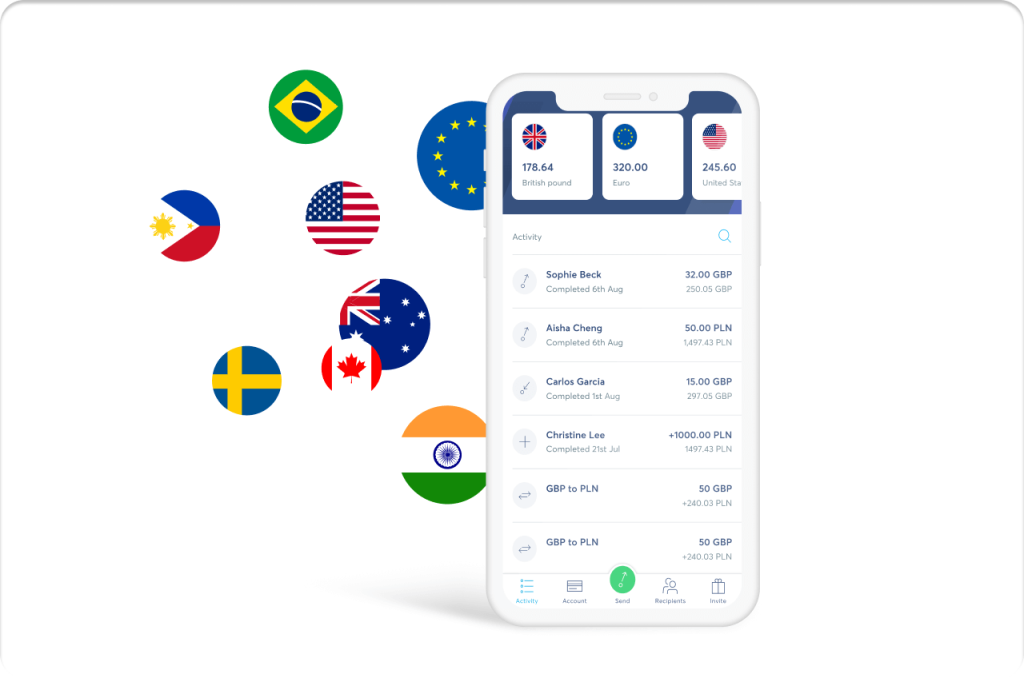

Multi-Currency Accounts

Wise’s multi-currency account is a standout feature, enabling users to hold, manage, and convert funds in over 40 currencies. This functionality is ideal for:

- Frequent travellers who require access to multiple currencies on the go.

- Freelancers working with international clients and receiving payments in various currencies.

- Global businesses managing payments across international markets.

The account allows you to efficiently send, receive, and convert money within a user-friendly platform.

Transparent Exchange Rates

Wise uses the real mid-market exchange rate, which you’ll find on Google or Reuters, without hidden markups.

Many traditional banks and competitors inflate their rates, charging an additional percentage on top.

However, when you use Wise, you’ll see a clear breakdown of fees before confirming any transaction to ensure you get the best possible value for currency conversion whilst avoiding any surprise fees often hidden in exchange rate markups.

Wise Debit Card

Wise offers a debit card linked directly to your multi-currency account, available in countries such as the UK, the EU, and the US. Key features include:

- Spend in 175 countries using your local currency balance or with a low conversion fee when spending in a different currency.

- Access to free ATM withdrawals (up to set limits, such as £200 per month, after which small fees apply).

- Integration with Apple Pay and Google Pay for contactless payments and ease of use.

The debit card offers real-time conversion at Wise’s low rates, making it perfect for travellers or individuals regularly spending across currencies.

Fast Transfers

Wise is renowned for its transfer speed, which varies based on currency and payment method.

Transfers between major currencies (e.g., USD, GBP, EUR) are often completed almost instantly, with other transfers typically taking 1-2 business days, making it a reliable choice for time-sensitive transactions.

Wise achieves this efficiency by working with local banking networks rather than relying on traditional international wire systems, making it faster and more reliable than many competitors.

User-Friendly Interface

Wise’s intuitive design ensures a smooth user experience across its web platform and mobile app.

Both platforms are highly rated for their ease of use and accessibility. Intuitive multi-currency account management makes it easy to view balances, exchange rates, and transaction histories.

You’ll also be able to set up transfers in minutes and track their status in real-time, with email or app notifications when money reaches its destination.

How Much Does It Cost To Use Wise

One of the biggest reasons I like Wise is how clear and upfront they are about fees. You always see exactly what you’re paying — no hidden markups tucked into the exchange rate, no nasty surprises once you hit “send”.

Wise uses the real mid-market exchange rate (the one you’d find on Google), and charges a small, transparent fee based on two parts:

- Flat Fee: Wise charges a small, fixed flat fee for some currencies. This ensures that customers know the minimum charge for their transfer upfront, regardless of the amount.

- Percentage Fee: Wise applies a percentage fee based on the transferred amount and currency. For example: Transferring £1,000 to EUR via a bank transfer costs approximately £3.88.

Here’s a snapshot to give you a feel for the pricing

| Transfer Method | Fee Type | Example Cost |

|---|---|---|

| Bank transfer (UK to EU) | Flat + % fee | ~£3.88 to send £1,000 to EUR |

| Debit card | Higher % fee | Slightly more than a bank transfer |

| Credit card | Highest fee | Often less cost-effective |

| Business account setup (UK) | One-time fee | £45 |

| Large transfers (£20k+) | Discounted % fee | As low as 0.1% + premium support |

Transfers funded via debit or credit card may incur slightly higher fees than bank transfers due to processing costs.

Customers who send more than £20,000 (or equivalent) can enjoy discounted fees starting at just 0.1%. They can also access dedicated, premium support for peace of mind.

While personal accounts are free to open, business accounts have a one-time setup fee (e.g., £45 in the UK), after which standard transfer fees apply.

What’s The Transfer Process Like?

Using Wise feels refreshingly straightforward. Whether you’re sending a one-off personal transfer or moving larger sums for business, the process is smooth, digital, and designed to keep you in control.

Here’s what it’s like step-by-step:

- Sign-up is quick: You can open a personal or business account online in minutes. For bigger transfers or business use, you’ll need to verify your identity by uploading a photo ID and proof of address. I’ve found this part fast and painless.

- Add your recipient: Just enter their bank details. Wise works with local bank accounts in each country, so your recipient doesn’t need to do anything—no Wise account is required on their end.

- Check the fees upfront: Before you hit send, you’ll see exactly how much it costs and when the money is expected to arrive. I really rate this transparency — it takes the guesswork out completely.

- Pay for your transfer: You can use a bank transfer, debit card, or credit card. I’d recommend a bank transfer for large amounts — it’s usually the cheapest route.

- Track everything in real time: Wise gives you email updates at each stage and a live progress bar in your account. If anything changes, you’ll be the first to know. I find this gives peace of mind, especially when moving large sums.

- Account management is easy: The app and website are clean, fast, and intuitive. With a few clicks, you can store recipient details, download receipts, or set up recurring transfers.

Customer Support

Wise keeps things largely self-serve, which suits many people, especially if you’re comfortable managing things online. That said, when you need help, support is there, though not always instantly.

Here’s what you can expect:

- Live chat and email are the main routes for support. There’s no 24/7 cover, but you can reach them during UK business hours, and I’ve usually had replies within a few hours.

- Phone support exists but is a bit hidden and reserved for more complex issues—you won’t find a call centre number front and centre.

- The help centre is solid, packed with step-by-step guides and genuinely helpful information. I’ve solved most issues this way without needing to contact anyone.

- Business users get slightly quicker support — not priority-level like with premium services, but you’re less likely to get stuck waiting.

In my experience, Wise support isn’t hand-holdy but reliable when needed. I think it suits confident users who value independence and clear guidance over constant access to someone on the phone.

If you’re moving very large sums or want more of a concierge-style experience, you might find the support a bit lean. But it works well for most day-to-day use, especially for tech-savvy senders.

Wise Customer Reviews

Wise is generally well-regarded by users, with consistently high ratings across platforms: 4.3 on Trustpilot, 4.8 on the Apple App Store, and 4.8 on Google Play. Most praise the service for fast transfers, low fees, and transparent exchange rates. I think sending quickly without hidden charges is one of Wise’s biggest strengths, especially for anyone managing regular cross-border payments.

Customers also highlight how easy the app is to use. Whether tracking transfers or managing multiple currencies, the platform is often described as smooth and intuitive. It’s especially popular among freelancers, expats, and small business owners who need to move money internationally stress-free.

That said, not everyone’s had a perfect experience. Some users report slow or unhelpful customer support, particularly when dealing with frozen accounts or delayed transfers. A few have run into technical glitches or found the communication unclear during issues. I think if something goes wrong, you might need to be patient—support doesn’t always move quickly.

Despite the negatives, most users still view Wise as a reliable and affordable way to send money abroad. It’s not flawless, but if speed, simplicity, and cost matter most to you, I think Wise gets a lot right. Just be aware that customer service can be hit or miss when problems arise.

Is Wise Safe For Transferring Money?

When it comes to handling your money, safety is a top priority — and I think Wise takes this seriously.

They’ve built a trustworthy reputation, and I feel confident knowing that my money is well-protected. It’s also worth noting that they stay ahead of the curve with their security updates, which is always reassuring when sending money internationally.

Here’s a breakdown of how they keep your data and transfers secure:

- Regulated by Financial Authorities: Wise is fully regulated by the Financial Conduct Authority (FCA) in the UK and other financial authorities worldwide. This means they’re subject to strict oversight, which gives me confidence that they operate under strong legal and financial rules.

- Advanced Encryption: They use high-end encryption technology to protect your personal data during transfers. This is pretty standard across serious fintech platforms, but knowing your information is safely locked down is always reassuring.

- Two-Factor Authentication (2FA): Wise encourages users to enable 2FA for an added layer of protection. This means that even if someone somehow gets hold of their password, they can’t access their account without the extra code sent to their phone. It’s a small hassle, but worth it for peace of mind.

- Separate Customer Accounts: Wise holds customer funds in segregated accounts. This means your money is kept separate from their business funds, so your money stays protected if they run into financial issues.

- Global Security Standards: As a global service, Wise follows industry-standard anti-money laundering (AML) and know your customer (KYC) procedures. They check your identity when you sign up, which helps prevent fraud and money laundering.

Wise Recent Updates and Recognitions

Starting with €10 million in transactions in its first year, Wise gained recognition and expanded globally, reaching £1 billion in monthly transfers by 2017.

In 2021, the company went public with a direct listing on the London Stock Exchange, rebranded from TransferWise to Wise, and introduced new services, such as interest-bearing accounts, through a partnership with BlackRock.

Wise was named the “Best App for Sending Money” in the 2024 Real Simple Smart Money Awards, reflecting its commitment to user satisfaction and competitive pricing.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. While we aim to ensure accuracy and relevance, the content may not reflect your specific circumstances or the most current developments in financial services.

Before making any financial decisions, including choosing a money transfer service, you should consult a qualified financial adviser who can provide guidance tailored to your individual needs and situation. Wise and other financial products mentioned in this article may not be suitable for everyone, and it is essential to consider all factors, including fees, exchange rates, and applicable regulations, before proceeding.

The use of this information is at your own discretion, and we disclaim any liability for decisions made based on the content provided. Always verify terms and conditions with the service provider directly.

Send Money Smarter With Currency Expert