Whether you’re transferring funds to loved ones across the globe or handling urgent payments, Western Union provides a wide range of options designed to suit different needs and preferences.

With over 500,000 agent locations worldwide, flexible payment methods, and multiple delivery options, it’s no surprise that many rely on Western Union for their money transfers.

In this article, we’ll explore the key features of Western Union’s services to help you make an informed choice on whether Western Union is the right money transfer solution for you.

- Should You Use Western Union?

- Western Union At A Glance

- Western Union Pros and Cons

- Who Is Western Union Best For?

- Western Union Key Features

- Global Coverage

- Multiple Ways to Send Money

- Fast and Convenient Transfers

- Flexible Receiving Options

- Loyalty Programme: My WU

- How Much Does It Cost To Use Western Union?

- What’s The Transfer Process Like?

- Customer Support

- Western Union Customer Reviews

- Are Western Union Money Transfers Safe To Use?

- Western Union Recent Updates and Recognitions

- Disclaimer

Send Money Smarter With Currency Expert

Should You Use Western Union?

Western Union can be a solid option if you need to send money quickly to someone you know and trust, especially across borders. I think the biggest draw is its reach. With a vast global network and options to send money online, via the app, or in person, it’s one of the few services that work almost everywhere. For repeat transfers, it’s generally fast and dependable, which is why so many loyal users stick with it.

That said, I’d be cautious if you expect a seamless, modern digital experience. The app can be glitchy (especially on Android), and customer service seems to be hit or miss. I’ve seen quite a few reviews from people frustrated by delays, vague refund policies, and identity verification that feels over the top, especially during urgent transfers. The service is reliable when it works, but getting help can be a slow and frustrating process when it doesn’t.

I also think it’s worth comparing costs if you’re sending small amounts. Fees can stack up fast, and now that their Rewards scheme has been scaled back, there’s less long-term value for frequent users. That said, for those sending larger amounts to countries where other options are limited, or for those who rely on in-person cash pick-up, it still holds its ground.

Western Union At A Glance

| Feature | Details |

|---|---|

| Best For | Fast, repeat personal transfers to trusted recipients in high-traffic corridors |

| Trustpilot Rating | ★★★★☆ (4.3/5 from 118,000+ reviews) – praised for speed and repeat reliability |

| Mobile App Ratings | iOS: ★★★★★ (4.8/5, 1M+ ratings) Android: ★★★★☆ (4.3/5, 319K ratings) |

| Transfer Speed | Often within minutes for card payments. Bank transfers may take longer. |

| Ease of Use | Generally user-friendly, but Android app prone to glitches and slow navigation |

| Customer Support | Mixed reviews – helpful at times, but slow response and poor refund handling noted |

| Fees | High for small transfers. Value declines without Rewards scheme |

| Transparency | Delivery times and fees not always clear upfront. Loyalty scheme scaled back |

| Data & Compliance | Users report repeated ID checks and intrusive data requests on some transactions |

| Transfer Limits | Varies widely by country, payment method, and user verification status |

| Agent Locations | Wide global coverage, but some users struggled to find operating branches locally |

| Security & Regulation | FCA-regulated in the UK Long-established with robust compliance frameworks |

Western Union Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Fast transfers are available in just minutes | Adds exchange rate markup |

| Cash pickup service | Charges transfer fees |

| Wide network of over 500,000 agent locations | Large transfers require additional verification |

| Multiple payment methods | Some services, like cash pickup, are not available everywhere |

| Mobile wallet transfers are available | You must be a UK resident to send transfers from the UK |

| My WU loyalty programme | I’ve seen the app freeze or glitch occasionally during peak times |

| Some locations are open 24/7 | |

| Well-rated mobile app (4.8 on Apple, 4.5 on Google Play) | |

| FCA-regulated with robust security and fraud prevention |

Who Is Western Union Best For?

Who Western Union Is Best For:

- People who need fast transfers with cash pickup options.

- Those sending money to regions where banking access is limited.

- Senders who need money delivered within minutes (using debit/credit cards).

- Frequent senders who can benefit from the My WU loyalty programme.

- Users who prefer multiple payment and transfer options (online, app, in person, Google Pay, Klarna).

Who It’s Not Ideal For:

- Cost-conscious senders, as exchange rate markups and fees can add up.

- Those sending large sums regularly, due to potential delays for verification checks.

- People needing a seamless experience with a reliable app (some users report glitches).

- Non-UK residents, as you must be a UK resident to send from the UK.

- Those sending to locations with limited Western Union service availability.

Western Union Key Features

Global Coverage

Western Union operates in over 200 countries and territories, with a vast network of agent locations and banking partners. Whether you’re sending money across the street or the world, Western Union makes it easy to reach your loved ones.

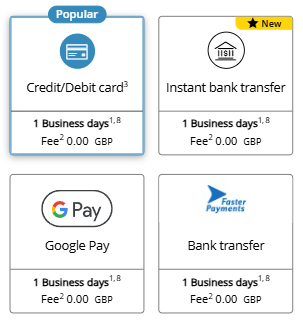

Multiple Ways to Send Money

Western Union gives you the flexibility to send money in a way that suits you. You can transfer money online via WesternUnion.com, through the Western Union mobile app, or in person at an agent location. Payment options include:

- Debit or credit card – for fast online transfers

- Bank transfer – pay directly from your online banking using Klarna, Trustly, or iDEAL

- Google Pay – a quick and secure option available on Android devices and the website

- Cash at an agent location – set up the transfer online and complete payment in person

Fast and Convenient Transfers

Need to send money in a hurry? Western Union offers money in minutes for cash pickups when paying by debit or credit card. If you’re sending to a bank account, the transfer usually arrives within one to two business days, depending on the country and receiving bank. Mobile wallet transfers can also be completed within minutes if the receiver has an activated wallet with a partner provider.

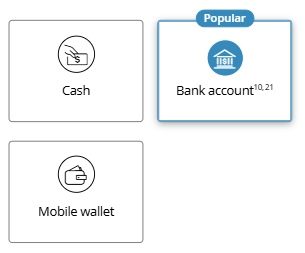

Flexible Receiving Options

Receivers have multiple options to collect their money:

- Cash pickup – available at hundreds of thousands of Western Union locations worldwide

- Bank deposit – money is sent directly to the recipient’s bank account, typically within 1–3 business days

- Mobile wallet – money can be sent directly to a mobile wallet for easy access if available in the recipient’s country.

Loyalty Programme: My WU

Frequent senders can earn rewards with Western Union’s My WU loyalty programme. Members can collect points on every transfer and redeem them for discounts on future transactions.

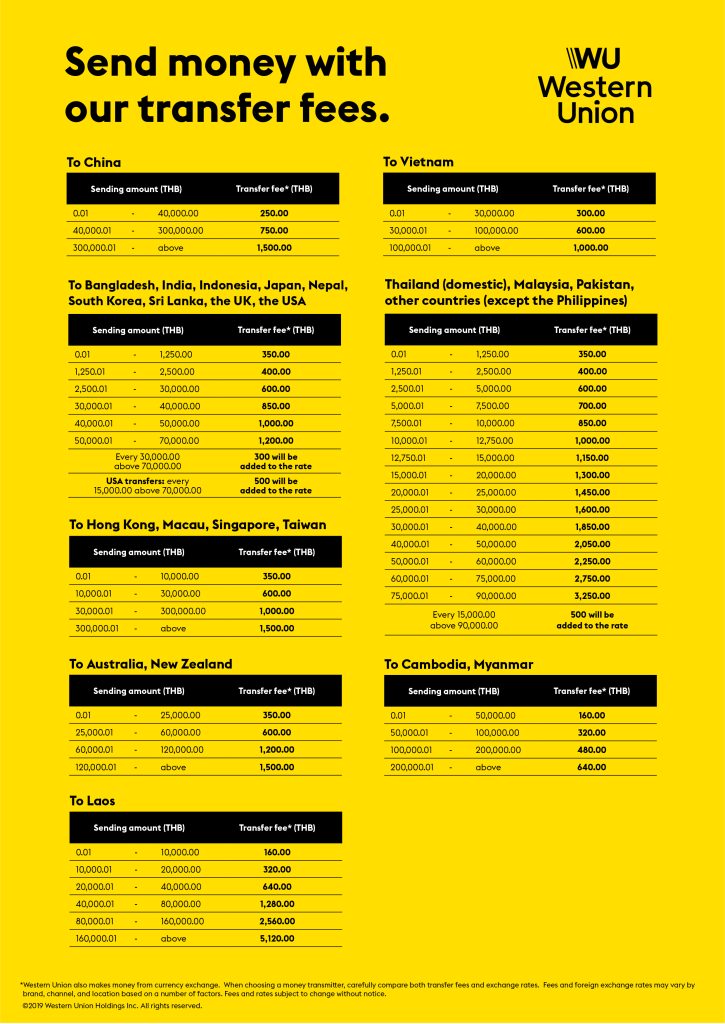

How Much Does It Cost To Use Western Union?

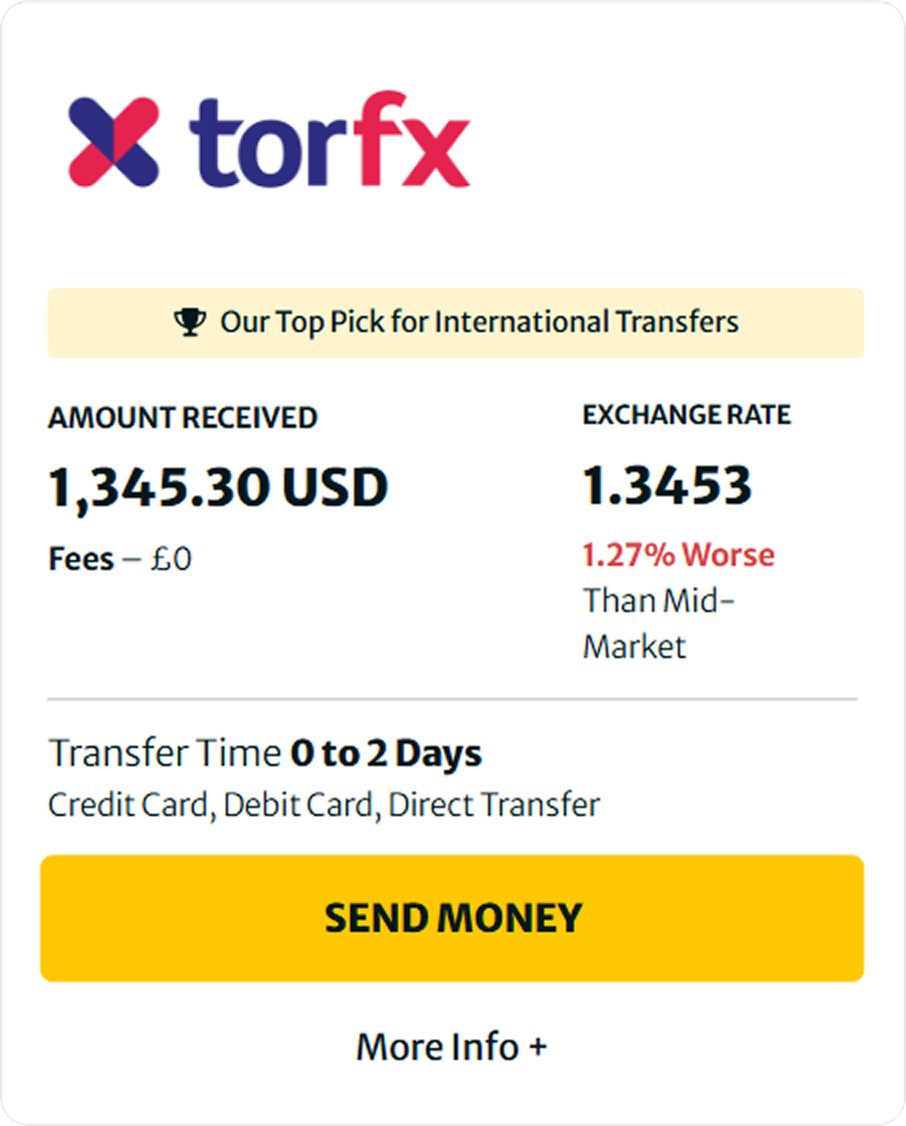

Western Union offers transparent pricing, but it’s important to note that fees and exchange rates can vary depending on the payment method, destination, and transfer speed. Here’s a breakdown to help you understand what you’ll be paying for.

- Transfer Fees: These are based on the payment method (e.g., credit card, debit card, bank transfer) and how quickly you need the money to reach the recipient.

- Exchange Rate Markup: Western Union applies a margin to the exchange rate, which means the rate you get may not be the exact market rate. This can add to the overall cost of your transfer.

- Additional Charges: In some cases, your recipient may need to pay a fee depending on how they receive the money, whether through a mobile wallet or bank deposit.

I think the fees can be a bit high, especially for smaller transfers. However, the convenience may be worth it for faster service or sending to regions with limited banking.

| Transfer Method | Fees | Speed |

|---|---|---|

| Debit/Credit Card | Fees start at £1.99, depending on destination | Fast (Minutes) |

| Bank Transfer | Varies by country and amount | 1–3 Business Days |

| Cash Pickup | £5.90 or more, depending on destination | Fast (Minutes) |

| Mobile Wallet | Varies by recipient country | Fast (Minutes) |

| Bank Deposit (to UK) | Starts at £0.99 | 1–3 Business Days |

What’s The Transfer Process Like?

Using Western Union to send money is straightforward, but there are a few steps to keep in mind. Here’s what you can expect from start to finish:

1. Signing Up

Signing up for Western Union is quick and easy. You can do it online through their website or via their app. For security reasons, you’ll need to provide your personal details and verify your identity. This is a standard process for money transfer services, and while it can feel like a hassle at first, it ensures your transactions are safe.

Pro tip: I think the verification process is smooth, but it might take some time if you’re a new user.

2. Choosing Your Transfer Type

Western Union gives you several options for transferring money:

- Bank account to bank account

- Credit/Debit card payments

- Cash pickup (where the recipient collects the funds in person)

You’ll pick the method that works best for you. Cash pickup is often the quickest option if you’re in a rush, but a bank transfer may be your best bet if you want a lower cost.

3. Starting the Transfer

Once you’ve chosen the transfer type, you’ll enter the details of the transaction:

- Recipient Information: Name, country, and payment method (bank details or cash pickup).

- Amount: Enter the amount you want to send, and Western Union will show you the total cost (including any fees and exchange rates).

- Payment Method: Decide how you’ll pay – with a debit card, credit card, or bank transfer.

4. Confirming the Transfer

Before confirming, you’ll see a breakdown of the fees and the estimated delivery time. Once you’re happy with everything, you’ll confirm the transfer. Depending on the method you selected, the recipient may have the funds in minutes or within a few days.

5. Tracking the Transfer

After your transfer is confirmed, you’ll get a Money Transfer Control Number (MTCN), which you can use to track the status of your transfer. You can check the progress online or through the app. If you’ve chosen a cash pickup, you can let the recipient know the MTCN, which they’ll need to collect the funds.

6. Receiving the Money

If you selected a cash pickup, the recipient can go to a nearby Western Union agent location with their ID and the MTCN. The money should be available almost instantly in many cases. For bank transfers, the funds will be deposited into the recipient’s bank account, typically within 1-3 business days.

Managing Your Account

Managing your account is easy through the Western Union website or app. You can check your transaction history, manage payments, and make new transfers whenever needed. I think the app is convenient—it’s simple to use, and you can make transfers on the go.

Overall Experience

The process is very user-friendly, and I find that it’s one of the easiest ways to send money internationally. It’s especially useful for urgent transfers, but the fees are worth considering if you’re sending larger amounts.

Customer Support

Western Union offers a decent range of support options, depending on how you want help.

Overall, I think the support is solid. You have enough options to get help, but live chat is the most hassle-free.

- Help Centre & FAQs: Their online Help Centre is well-stocked with answers to common questions. I think it’s handy for sorting out basic issues without contacting anyone.

- Live Chat: Live chat is quick and available during business hours. In my experience, agents are friendly and efficient—this is usually my go-to.

- Phone Support: They have phone lines for personal and business customers. The help is good, but wait times can drag, especially at busy times.

- Social Media: You can reach out on Twitter or Facebook. I’ve had fairly quick responses here, and it’s a convenient option when you’re on the go.

- In-Person Help: If you’re near an agent’s location, you can speak to someone face-to-face. This is ideal for those who prefer hands-on support.

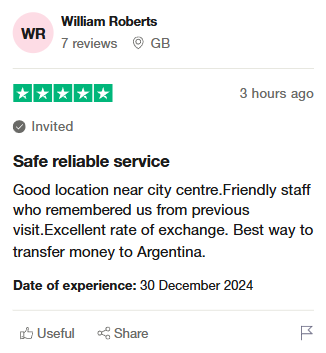

Western Union Customer Reviews

If I had to sum up how people feel about Western Union, I’d say there’s a real split—loyalty on one side, and growing frustration on the other.

Plenty of customers clearly rate it. With over 118,000 Trustpilot reviews and a 4.3-star average, the feedback skews positive overall. People love the fast and easy transfers, especially if they’re repeat users. I’ve seen a lot of “smooth,” “quick,” and even “perfect” being thrown around—usually by folks who send money regularly and value reliability above all else. There’s also real trust in the brand; many say they’ve used it for years without any issues. That kind of consistency goes a long way.

But it’s not all glowing. I think some of the most common gripes feel especially relevant for anyone sending money frequently or for personal emergencies. Many reviews mention high fees, especially on smaller transfers, which can really eat into what your recipient gets. Others were put off by the loyalty scheme being watered down, which used to be a nice perk. If you’re sending money abroad every month, those little extras matter.

From what I’ve seen, Western Union struggles with customer support and transparency. Some users described long delays, cancelled transactions without a clear reason, and slow refunds. I understand how that would be particularly stressful if you’re trying to pay something urgent, like school fees or hospital bills. The app, while rated highly on the Apple Store, still draws a lot of complaints, especially on Android, with glitches, poor navigation, and inconsistent functionality.

If I were choosing a service, I’d weigh the convenience and long-standing trust against the rising number of complaints, particularly if I needed speed, reliability, and human support during urgent transfers.

Are Western Union Money Transfers Safe To Use?

Western Union is a well-established, FCA-regulated money transfer provider with a long track record, so it’s solid from a safety perspective.

Western Union takes security seriously. I like that they don’t just rely on tech—they’ve got boots on the ground, too, especially with agent location checks. Knowing these protections are in place is reassuring if you’re sending high-value transfers or using the service often.

Here’s how they help keep your money and personal data secure:

- Regulated by the FCA (Financial Conduct Authority) in the UK

- Encryption technology protects your personal and payment details during every transaction

- Two-factor authentication (2FA) adds an extra layer of login security

- 24/7 fraud monitoring flags suspicious activity on your account

- Verified agent locations to ensure in-person cash pickups are safe

- ID verification required for certain transactions to prevent fraud

- Customer support for reporting scams or suspected misuse

Western Union Recent Updates and Recognitions

Western Union was founded in 1851 in Denver, Colorado, as the New York and Mississippi Valley Printing Telegraph Company. Over time, it evolved from a telegraph service to the world’s largest provider of cross-border money transfers.

Western Union deepened its long-term partnership with Mastercard in 2021, integrating Mastercard Send into its platform. This integration allows customers to send money directly to debit cards in 16 European markets, with more countries to follow. This service speeds up transfers and provides greater convenience for recipients, making the process more seamless and immediate.

In 2022, Western Union expanded its collaboration with the UK Post Office to enhance its omni-channel offering. This means UK customers can now send money internationally through 4,000 Post Office locations across the UK. This collaboration strengthens Western Union’s reach and accessibility, especially in communities with limited local banking services.

Disclaimer

The information in this article is for general purposes only and is not financial advice. While we try to keep everything accurate and up-to-date, it may not apply to your specific situation or reflect the latest changes in money transfer services.

Before making any financial decisions, such as choosing a money transfer service, speaking with a financial adviser who can advise you based on your needs is a good idea. Western Union and other services mentioned may not be right for everyone, so consider fees, exchange rates, and regulations before moving forward.

You are responsible for how you use this information, and we are not liable for any decisions you make based on it. Always check the terms and conditions with the service provider before completing any transactions.

FAQs

Western Union money transfer allows you to send money to someone across the world through various methods. You can send money online, via their mobile app, or in person at an agent’s location. Payment can be made using a debit/credit card, bank transfer, or cash. The recipient can collect the money in several ways, including cash pickup at an agent location, bank deposit, or mobile wallet transfer.

Western Union’s fees for sending money depend on several factors, including the payment method, the destination, and how quickly the money needs to be transferred. For example, paying by debit or credit card usually incurs a higher fee, while bank transfers may be cheaper. Fees can also vary based on the transfer amount and the type of delivery method chosen (such as cash pickup or bank deposit). Western Union provides upfront pricing before you send money, so you can see the exact cost before completing the transaction. Additionally, they may apply a markup on exchange rates.

Yes, Western Union is generally considered safe for money transfers. The company uses advanced encryption to protect personal information and follows secure payment standards. It also has identity verification processes for larger transfers, monitors transactions for suspicious activity, and requires recipients to provide identification to pick up funds.

The Western Union transfer limits vary depending on your identity verification status and transfer method. You can send up to £800 per transfer online if your identity hasn’t been verified. Once verified, you can send up to £4,000 every three days using a credit card or up to £50,000 via a bank transfer. There are usually no set limits for in-person transfers, but for larger amounts, you may need to provide additional information or documentation for security checks.

The time for a Western Union bank transfer depends on the destination and the receiving bank. Typically, transfers to bank accounts take between one to two business days. However, the exact duration can vary depending on the country and the specific bank receiving the funds. If you need to send money quickly, Western Union offers faster options, such as cash pickups or mobile wallet transfers, which can be completed in minutes.

Sending money through Western Union can be a good option if you need fast, reliable transfers, especially for international transactions. With a vast network of agent locations and multiple payment methods, it offers flexibility and convenience. However, the fees can be higher than some alternatives, and the exchange rates may include a markup. Considering these factors and ensuring the service meets your specific needs before using it is essential.