Helping over 425,000 people send money abroad, TorFX is a popular choice for personal and business customers.

The company recently won the People’s Choice award at the 2024 Good Money Guide Awards and is known for its competitive exchange rates, flexible transfer options, and personalised service.

In this review, I’ll explore TorFX’s key features, pricing, security measures and more to help you decide if it’s the right choice for your international money transfer needs.

Send Money Smarter With Currency Expert

- Should You Use TorFX Money Transfers?

- TorFX At A Glance

- TorFX Pros and Cons

- Who Are TorFX Money Transfers Best For?

- TorFX Key Features

- Competitive Exchange Rates

- Flexible Transfer Options

- Fast and Reliable Transfers

- Diverse Currency Support

- Regular Overseas Payments

- Dedicated Account Management

- How Much Does It Cost To Use TorFX?

- What’s The Transfer Process Like?

- Getting Started: Simple Sign-Up

- Making Transfers: Flexibility at Your Fingertips

- Tracking Your Transfers: Keep Tabs on Your Money

- Cutsomer Support

- Personalised Account Management

- Multiple Support Channels

- Fast Response and Proactive Updates

- Self-Service Resources

- TorFX Customer Reviews

- Is TorFX Safe To Use?

- TorFX Recent Updates and Recognitions

- Disclaimer

Should You Use TorFX Money Transfers?

If you’re planning a large international transfer—especially for property, emigration, or business—I think TorFX is a solid choice. The personal account manager model is genuinely helpful when you’re sending big sums or want tailored guidance, and most customers seem to appreciate having a real person help them navigate the process.

You won’t pay any transfer fees, and exchange rates are typically competitive, though the actual margin varies by deal. I’d say it’s ideal if you’re after hands-on support, value security and regulation, and don’t mind speaking to someone before locking in your rate.

That said, if you want to send small amounts quickly and independently through an app without chatting to anyone, this probably isn’t the best fit. It’s more suited to people or businesses that prefer a relationship-based service over a fully digital one.

TorFX At A Glance

| Feature | Details |

|---|---|

| Best For | Large personal or business transfers (£10k+), overseas property, emigration |

| Not Ideal For | Small transfers, app-only users, and those wanting instant digital payments |

| Transfer Fees | None |

| Exchange Rates | Competitive – margins vary (typically 0.5–1.5%) |

| Minimum Transfer | £100 |

| Transfer Speed | Same-day to 2 working days (depending on currency and time of transfer) |

| Customer Support | Dedicated account manager, phone & email support |

| Mobile App | Available (iOS & Android), but not always entirely reliable |

| Trustpilot Rating | 4.8 / 5 from 8,400+ reviews |

| Regulation | FCA authorised & regulated (FRN: 900706) |

| FSCS Protection | No, but client funds are held in segregated accounts |

| Supported Currencies | 40+ including EUR, USD, AUD, NZD, ZAR |

| Countries Served | UK, Australia, Europe, South Africa, others |

TorFX Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| No Transfer Fees | No FSCS Coverage |

| Supports Over 40 Currencies | Doesn’t Offer A Cash Pickup Service |

| Fix exchange rates up to 2 years in advance | Limited Travel Money Services |

| Dedicated Account Managers | Minimum Transfer Amount of £100 For Online Transfers or £500 for Regular Payments |

| Facilitates Regular Payments | Occasional delays in customer service responses |

| Fast Transfers Usually Within 2 Working Days | |

| No Maximum Transfer Limits |

Who Are TorFX Money Transfers Best For?

TorFX Is Best Suited To

- Businesses with frequent overseas payments: TorFX’s regular overseas payments service is ideal for recurring transactions, such as paying overseas salaries, mortgages, or tuition fees. Automating regular payments can save businesses a lot of time.

- Mid to large-sized businesses: With no transfer limits and the ability to send up to £10 million, TorFX is perfect for companies with large transfer needs, allowing them to move big sums without hassle.

- Personal customers sending large sums: If you’re an individual making a one-off or recurring transfer (such as a property purchase abroad or pension transfers), the ability to send amounts from £100 to £10 million makes TorFX a solid option.

- Those who value personal service: TorFX offers dedicated account managers, which I think is an excellent feature for anyone, whether personal customers or businesses, who prefers tailored guidance throughout the process.

- Customers seeking competitive exchange rates: If getting a better exchange rate matters to you, TorFX offers rates closer to the interbank rate, making it a smart choice for anyone wanting to get the best deal.

TorFX Is Least Suited To?

- Small businesses or personal customers with small transfers: The minimum transfer amount of £100 may be too high for some individuals or smaller companies with occasional, smaller transfers.

- People who need cash pickup options: TorFX doesn’t offer cash pickup services, so it’s not suitable if you’re looking to send money for someone to collect in person.

- Those who need FSCS protection: TorFX doesn’t offer FSCS coverage, which could be a dealbreaker for those who value this added security.

- Customers requiring instant or 24/7 transfers: While TorFX is generally fast, there may be delays for exotic currencies or during busy periods, so it may not be ideal for people who need transfers to happen immediately.

TorFX Key Features

Here’s a breakdown of TorFX main features for businesses.

Competitive Exchange Rates

TorFX offers highly competitive exchange rates, often better than those provided by banks. The service operates on smaller margins, ensuring customers get rates closer to the interbank rate, maximising the value of every transfer.

Flexible Transfer Options

TorFX offers flexible transfer options to suit a variety of needs and preferences:

1/ Phone Transfers: Customers can arrange transfers over the phone with their personal account manager. This option provides tailored guidance and ensures clarity for every transaction.

2/ Online Transfers: The TorFX Online platform allows customers to send money 24/7. Ideal for transfers below £25,000, it offers features such as monitoring transfer history, setting up rate alerts, and managing account details.

3/ Forward Contracts: Lock in current exchange rates for future transfers, protecting against currency fluctuations.

4/ Market Orders: Set a target exchange rate, and TorFX will execute the transfer automatically when the market reaches your desired rate.

These options ensure customers can transfer funds conveniently, securely, and at competitive rates, whether managing one-off payments or planning for future currency needs.

Fast and Reliable Transfers

Transfer times depend on the currency and destination but are generally processed within the same day or up to two working days for exotic currencies, ensuring funds reach their destination quickly and securely.

Diverse Currency Support

TorFX supports over 40 global currencies with no maximum transfer limit. Customers can transfer amounts as low as £100 or as high as £10 million, catering to small and large requirements.

Regular Overseas Payments

TorFX offers a Regular Overseas Payment service tailored to customers who frequently need to transfer funds abroad. This option is ideal for recurring payments such as:

✅

Mortgage or rental payments abroad

✅

Pension transfers

✅

Overseas salaries or tuition fees

This service is designed for transfers between £500 and £10,000, allowing customers to automate payments, saving time and ensuring consistency in meeting their obligations abroad.

Dedicated Account Management

Upon registration, customers are assigned a personal Account Manager. This dedicated support provides guidance, updates on market movements, and assistance executing transfers, ensuring a smooth and informed process.

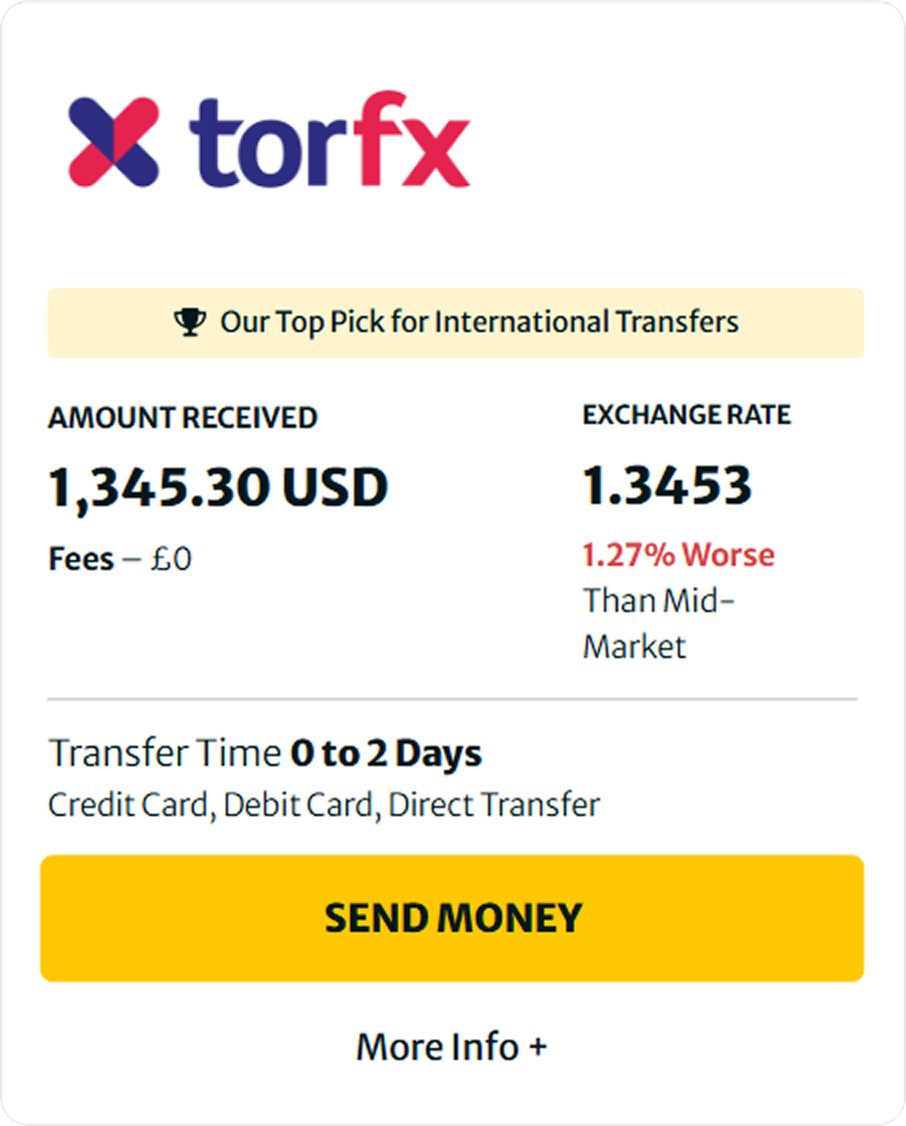

How Much Does It Cost To Use TorFX?

TorFX stands out for its transparent and cost-effective pricing structure.

❎ No Transfer Fees: Customers avoid typical transfer costs, allowing them to send money internationally without additional charges. TorFX’s no transfer fees and competitive exchange rates make it an excellent choice for larger transfers, but if you’re sending small amounts, remember the minimum transfer limit of £100.

💸 External Fees: While TorFX does not charge fees, external charges may apply, including intermediary fees for transfers processed through the SWIFT network and receiving fees. Customers are advised to check with the recipient’s bank for potential charges, which vary depending on the banks, countries, or currencies involved.

What’s The Transfer Process Like?

With TorFX, you can expect a more tailored, hands-on approach. Its ability to lock in rates, track payments, and have direct support throughout the process makes it a solid choice.

Getting Started: Simple Sign-Up

Signing up with TorFX is straightforward. You’ll begin by registering online and providing basic details like your personal or business information. After registration, you’ll be assigned a dedicated Account Manager to guide you through the process. This personalised support is a big advantage whether you’re a personal customer or a company. I think it makes a real difference when you have someone on hand to answer questions and help you navigate the system.

Making Transfers: Flexibility at Your Fingertips

Once your account is set up, you can choose from several ways to send money, depending on your needs:

- Online Transfers: Ideal for sending money quickly, especially for transfers under £25,000. You can track your transfer history, set rate alerts, and manage your account 24/7 through the TorFX platform.

- Phone Transfers: If you prefer more guidance, you can arrange your transfer over the phone with your Account Manager. This is great for larger transfers or those needing extra attention.

- Forward Contracts: To protect yourself from fluctuating exchange rates, TorFX allows you to lock in the current rate for future transfers. This is particularly helpful for businesses making regular international payments or personal customers with planned payments abroad.

Tracking Your Transfers: Keep Tabs on Your Money

TorFX offers a reliable tracking system, so you’ll always know where your funds are. You can follow your transfer online and receive updates from your Account Manager, ensuring peace of mind. Having this transparency is vital if you’re transferring a large sum or sending money overseas frequently. I find it comforting to know exactly when the money is expected to reach its destination.

Cutsomer Support

Personalised Account Management

One of the features that really sets TorFX apart is its dedicated Account Manager. From the moment you sign up, you’re assigned a personal contact who offers tailored advice and support throughout your transfers. Whether you’re an individual or a business, having someone you can speak to directly gives a sense of confidence and clarity. I find it reassuring knowing someone is guiding me through the process, especially for larger or more complex transactions.

Multiple Support Channels

TorFX provides a variety of ways to get in touch, which I think is a huge plus:

- Phone Support: Speaking to an Account Manager or customer service on the phone is great if you need something sorted quickly or want to ask detailed questions.

- Email Support: If you have a more complex query or prefer written responses, their email support is responsive and transparent.

- Online Portal: The portal allows you to manage your transfers easily, track your payments, and make updates. It’s very straightforward and accessible.

Fast Response and Proactive Updates

In my experience, TorFX delivers on quick response times. Whether you’re sorting out a problem or just need some clarification, they’re on the ball. I particularly appreciate their proactive service, which keeps you updated on things like market changes or transfer progress. I’ve found that the timely communication gives me peace of mind, knowing I’m never left in the dark about my transfer.

Self-Service Resources

For those who prefer to handle things themselves, I think TorFX’s self-service tools are pretty helpful. Their comprehensive FAQs answer most common questions about fees, exchange rates, and transfers. The rate alerts are also a nice touch, allowing you to monitor rates and jump on the best deal when it appears.

TorFX Customer Reviews

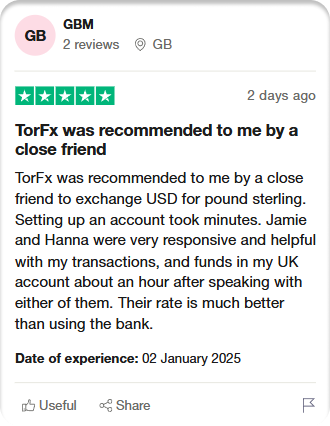

TorFX gets a lot of love from customers—and I can see why. On Trustpilot, it’s rated 4.8 out of 5 from over 8,400 reviews, with users repeatedly praising the personal service. Many people mention how helpful and professional their dedicated account managers are, especially during high-stakes transfers like buying property overseas.

I think what stands out is how reassured people feel. Customers talk about how smoothly the process runs, how fast the transfers are, and how easy it is to get someone on the phone if there’s a hiccup. Quite a few also mention the competitive rates and how much they value being guided through complex transactions.

That said, not every review is glowing. Some people found the service clunky or inconsistent, particularly when the app misbehaved or when transfer limits got in the way. A few felt the exchange rates weren’t as competitive as advertised, or were frustrated by the lack of transparency around fees.

The mobile app scores similarly well—4.8 stars on the Apple App Store and Google Play—but users mention occasional glitches and wish for better visibility into their transfer history. Despite that, most still say it’s easy to use, secure, and reliable.

Is TorFX Safe To Use?

When it comes to transferring money, safety is a top concern for anyone, and I think TorFX takes this seriously. As a regulated and trusted service, TorFX provides several important safety features to ensure the security of your money and data.

Safety Features in Place:

- Regulated by the FCA: TorFX is authorised by the Financial Conduct Authority (FCA), which provides a strong layer of regulation. This means they must follow strict rules to protect customers and ensure their funds are handled properly.

- Client Money Protection: TorFX holds client funds in segregated accounts, meaning your money is kept separate from the company’s operating funds. This ensures that your funds are safe in the unlikely event of a company issue.

- AML & KYC Compliance: TorFX follows Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations. This not only helps prevent fraud but also ensures they are working within the law to protect customers and their businesses.

- Encryption and Secure Data Handling: They use industry-standard encryption to protect sensitive data, which is crucial when dealing with personal information and banking details. I think this level of security is vital when making international transfers online.

- Transparent Fees and Rates: TorFX is clear about its fees and exchange rates, which helps to prevent hidden costs that can sometimes arise with less transparent services.

TorFX Recent Updates and Recognitions

TorFX has garnered significant recognition for its exceptional service in the money transfer industry. From 2016 to 2022, the company was awarded International Money Transfer Provider of the Year at the Moneyfacts Consumer Awards, highlighting its sustained excellence and competitiveness in the market.

In addition, TorFX was repeatedly honoured with the Best Customer Service award in 2016 and 2017, and from 2019 to 2022, it has outshined over 100 companies across 26 categories. This achievement underscores TorFX’s commitment to delivering outstanding customer support with personalised assistance from dedicated Account Managers.

Most recently, TorFX won the People’s Choice award at the Good Money Guide Awards and was also Highly Commended for Best Service from a Business FX Provider at the Business Moneyfacts Awards 2023, further solidifying its position as a leading provider in both personal and business foreign exchange services.

Disclaimer

The information provided in this article is for informational purposes only and should not be considered financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to note that individual circumstances vary, and the suitability of financial products or services will depend on your specific situation.

Before making any significant financial decisions, including choosing a money transfer provider, we strongly recommend consulting a qualified financial adviser who can provide personalised guidance tailored to your needs. TorFX’s services and any comparative insights discussed herein should be evaluated in the context of your unique requirements and objectives.

We do not accept responsibility for any decisions made based on the information provided in this article. For more detailed advice, please seek professional assistance.

FAQs

Yes, TorFX is generally considered safe for transferring money. The company follows stringent security measures, including safeguarding client funds in segregated accounts and employing strong encryption to protect transactions.

TorFX is generally trustworthy, with a solid reputation and multiple awards, including International Money Transfer Provider of the Year at the Moneyfacts Consumer Awards from 2016 to 2022.

Yes, TorFX is a legitimate company. It’s authorised and regulated by the UK’s Financial Conduct Authority (FCA), ensuring it operates within strict legal and regulatory guidelines. TorFX also uses secure, transparent processes for handling transactions, making it a reliable and trusted choice for international money transfers. Based on this, I believe it’s a safe and trustworthy service for both personal and business users.

TorFX doesn’t charge any upfront transfer fees. Instead, they incorporate a small margin into the exchange rate they offer. This margin typically ranges from 0.5% to 2%, depending on the currencies involved and the transaction amount. The margin tends to be lower for larger transfers, making it more cost-effective than traditional banks. However, it’s important to note that some receiving or intermediary banks may impose their own fees, which are outside of TorFX’s control and can affect the total cost of the transfer.

Yes, TorFX is a legitimate company. It is authorised and regulated by the UK’s Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI), holding FCA Firm Reference Number 900706. This regulation ensures that TorFX adheres to strict financial standards and safeguards client funds. Additionally, TorFX is part of a group that processes over £10 billion in international payments annually and has been operational since 2004.

TorFX aims to process most transfers on the same day or within two working days, depending on the currency, destination, and receiving bank. For commonly traded currencies like EUR, USD, and CAD, transfers are typically completed the same day if instructed before noon (UK time). For more exotic currencies or destinations, transfers may take up to two working days.

TorFX operates in over 120 countries and supports more than 40 currency transfers. While it offers services in major regions like the UK, Australia, and the USA, it does not accept customers from countries such as Afghanistan, Cuba, Iran, Russia, and others due to regulatory restrictions.

Yes, TorFX is a legitimate and trustworthy company. Regulated by the FCA and with funds held in segregated accounts, your money is well-protected. With an Excellent Trustpilot rating of 4.8/5 from over 8,000 reviews, customers praise its personalised service and competitive rates. In short, TorFX is a secure choice for international transfers.