Revolut has rapidly become a go-to option for many who want to send money internationally, thanks to its user-friendly app, competitive exchange rates, and range of convenient features.

Whether sending money to family abroad, making a business payment, or managing currency across borders, Revolut promises a seamless and efficient transfer process.

In this review, we’ll examine Revolut’s money transfer service’s key features, pros and cons, and real user experiences to help you decide if it’s the right choice for your international transactions.

- Should You Use Revolut Money Transfer Service?

- Revolut Transfers At A Glance

- Revolut Money Transfer Pros and Cons

- Who Are Revolut Transfers Best For?

- Unsuitable For

- Revolut Money Transfer Key Features

- Supported Currencies and Destinations

- Competitive Exchange Rate

- Varied Payout Options

- Fast Transfer Speeds

- Real-Time Tracking

- Business Transfer Tools

- Spending Limits and Alerts

- How Much Does It Cost To Transfer Money Using Revolut?

- What’s The Transfer Process Like?

- 1. Sign-Up Process

- 2. Account Manager (for Premium Plans)

- 3. Making a Transfer

- 4. Tracking Transfers

- 5. Delivery and Receiving Funds

- Revolut Customer Support

- Revolut Customer Reviews

- Is Revolut Safe To Use?

- Revolut Recent Updates and Recognitions

- Disclaimer

Send Money Smarter With Currency Expert

Should You Use Revolut Money Transfer Service?

If you’re already using Revolut for everyday banking, sending money abroad can be convenient. For personal customers, the standout benefit is access to interbank exchange rates—typically reserved for financial institutions—on most plans. However, your subscription depends on how much you can transfer at these rates. Standard (free) users get £1,000/month at the best rates Monday to Friday, while Ultra customers (£45/month) can transfer unlimited amounts without weekday or weekend mark-ups. Weekend transfers on lower-tier plans come with extra fees—something to watch out for if you need flexibility.

The value really starts to show if you’re already paying for one of the higher-tier plans like Premium, Metal or Ultra. These include added perks like global travel insurance, cashback, and fee-free international transfers, making the money transfer benefits part of a broader package. But if you’re purely looking to transfer money and don’t use Revolut for daily banking, the value is less clear unless you send regularly and at scale.

For businesses, Revolut’s plans offer a lot more control and flexibility. From £10/month, even Basic users can send, receive, and exchange in 25+ currencies. Higher plans unlock generous no-fee transfer allowances and better exchange rate limits—ideal if you make frequent or high-volume payments overseas. Plus, Revolut supports bulk payments and integrations with accounting platforms, which I think really helps streamline operations.

In short: Revolut works best if you’re already using it—or plan to—for broader personal or business banking, not just transfers.

Revolut Transfers At A Glance

| Key Feature | Details |

|---|---|

| Ideal Users | – Individuals sending £5k+ internationally – Expats, remote workers, high-frequency senders – SMEs scaling cross-border |

| Transfer Type | Personal & Business international money transfers |

| Transfer Method | Bank-to-bank (no cash payout); app/web-based |

| Speed | 1–2 business days (standard); same-day for many routes |

| Currencies Supported | 30+ currencies |

| Exchange Rate | Interbank rate (real-time) Weekend markup: – Standard: 1% – Plus: 0.5% – Premium & above: none |

| Transfer Fees (Personal) | Varies by plan: – Standard: Full fee – Plus: 20% off – Premium: 40% off – Metal/Ultra: Free |

| Transfer Fees (Business) | Monthly fee covers allowance: – Basic: fees apply – Grow/Scale: free transfers within limits |

| Monthly FX Allowance | Personal: £1,000 on free plan (then 1%) Business: from £1,000 to £60,000+ depending on plan |

| Min/Max Transfer Amounts | No minimum High maximums; ideal for large transfers |

| Regulation & Security | FCA-authorised; funds safeguarded under e-money rules |

| Transfer Setup | Fully app-based (mobile & desktop) Fast onboarding and intuitive interfa |

| Business Tools | Bulk transfers, approval workflows, APIs, integration with Xero & QuickBooks |

| Support Access | 24/7 in-app chat (priority on higher tiers) Business plans include live agent support |

Revolut Money Transfer Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Free Revolut-to-Revolut transfers | 1% weekend/ out of market hours transfer fee |

| Supports 30+ currencies to 150+ destinations | Monthly limits on free transfers |

| Competitive interbank exchange rates | Some delays on SWIFT and card transfers |

| Fast transfers | No cash pick-up service |

| Multiple payout options (bank, card, payment link, group bills) | Not all currencies are supported (e.g. AFN, BYR) |

| Business tools like bulk payments and API integration | Occasional reports of account access issues |

| Real-time tracking on all transfers | |

| Transfers can be instant, especially Revolut-to-Revolut and SEPA. | |

| Spending limits and alerts help with budgeting |

Who Are Revolut Transfers Best For?

Suitable For

- Frequent travellers: If you’re regularly sending money abroad or exchanging currencies, Revolut’s competitive exchange rates (especially on weekdays) and support for over 30 currencies make it a solid choice.

- Business users: Revolut’s business tools, such as bulk payments, API integrations, and custom approval workflows, are great for managing international payroll, supplier payments, and larger transactions.

- Tech-savvy users: Revolut’s easy-to-use app, which offers real-time tracking and instant transfers, is ideal for those comfortable with digital banking and financial management.

- Small-to-medium-sized businesses: With transparent pricing and no hidden fees (as long as you stay within your plan’s limits), Revolut works well for businesses looking to manage cross-border payments efficiently.

Unsuitable For

- Users needing cash pick-up services: Revolut doesn’t offer cash collection or pick-up services, so if this is a key requirement for your recipient, you might want to consider other options.

- People making transfers on weekends or outside market hours: The 1% surcharge on weekends may not be ideal if you need to regularly make transfers during these times.

- Users with specific currency needs: While Revolut supports a broad range of currencies, it doesn’t cover every option (e.g., Afghan Afghani or Belarusian Ruble), so if you need niche currencies, it might not meet your needs.

- Those looking for extensive customer support: Although Revolut has a strong reputation, some users have noted account access and support issues. You may find this a bit lacking at times if you need hands-on, immediate customer service.

Revolut Money Transfer Key Features

Revolut’s international money transfer service is packed with features to simplify sending money abroad.

Supported Currencies and Destinations

Revolut enables users to transfer money in over 30 currencies to more than 150 countries. This includes popular currencies such as GBP, EUR, USD, and AUD, ensuring wide-reaching access to international markets.

However, it’s important to note that certain currencies, like Afghan Afghani (AFN) and Belarusian Ruble (BYR), are unsupported.

Competitive Exchange Rate

Revolut uses interbank exchange rates for currency conversions, offering some of the most competitive rates available in the market. These are the same rates banks use when trading currencies with each other, ensuring minimal markups.

During weekdays, users can enjoy these rates without additional fees as long as their transfers stay within the monthly allowance set by their plan. However, on weekends, a small markup of around 1% applies to protect against fluctuations when the markets are closed. This transparency helps personal and business users confidently plan their transfers, knowing they’re getting a fair and consistent rate.

Transfers exceeding the monthly allowance may incur a fair usage fee, but all charges are clearly displayed in the app before completing the transaction, ensuring no surprises.

Varied Payout Options

Revolut offers a range of payout options, including:

- Bank transfers to 160+ countries.

- Card transfer to eligible Visa or Mastercard cards.

- Transfers to other Revolut customers

- Payment link transfers

- Group Bills to split expenses.

They also plan to launch mobile wallet transfers using the recipient’s mobile phone number soon.

Fast Transfer Speeds

Whether sending funds to a family member abroad or managing large-scale business payments, the transfer speed depends on your chosen method, destination and currency.

- Revolut-to-Revolut Transfers: Instant

- SEPA (Within the EU): Typically processed instantly for payments up to €100,000 when using SEPA instant. However, if the recipient’s bank does not support SEPA Instant or the amount exceeds the limit, transfers may take up to 2 business days.

- SWIFT Transfers (International Bank Transfers): The speed depends on intermediary banks and the destination country, but most payments take 2-5 business days.

- Card Transfers: Instant to 30 minutes (rare delays up to 48 hours)

- Payout Links: Recipient decides when to claim (up to 7 days)

Real-Time Tracking

Both personal and business users can monitor the status of their transactions in real-time, which provides transparency and peace of mind.

Business Transfer Tools

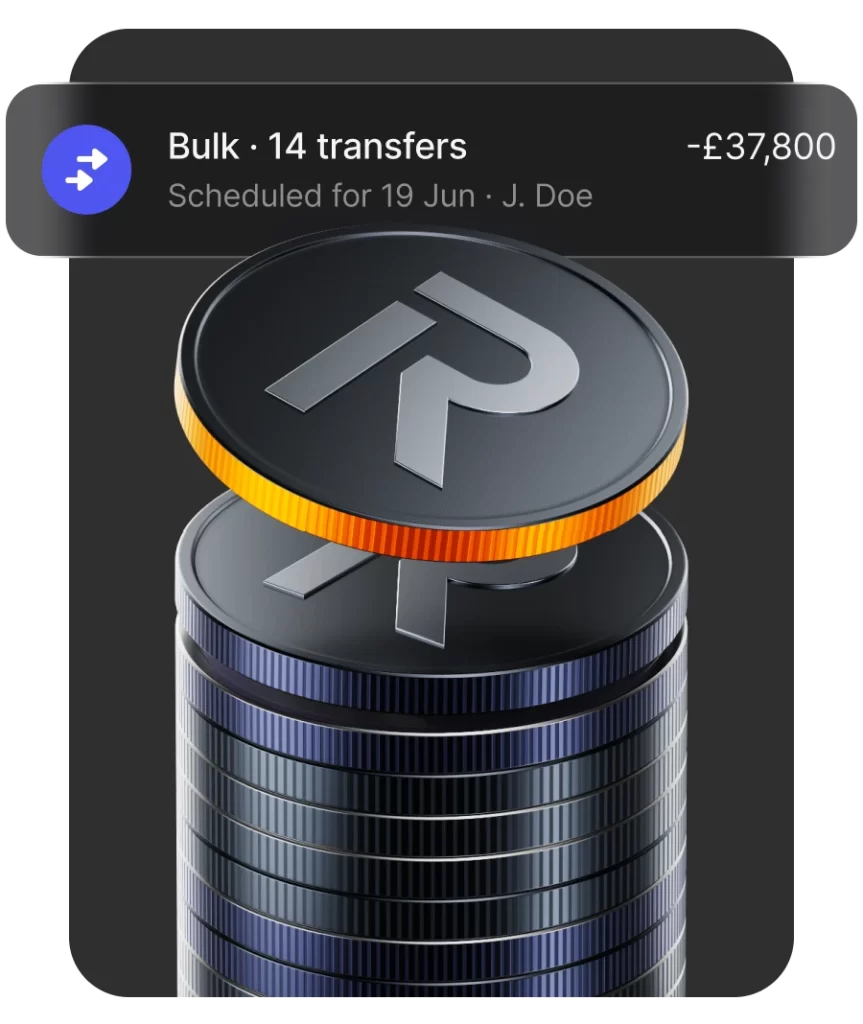

Businesses can send bulk payments for up to 1,000 employees or suppliers or use API integrations to automate payments, ideal for payroll and supplier settlements.

You can also set up custom approval workflows, ensuring better oversight and accountability for large or sensitive transfers.

Spending Limits and Alerts

Users can set spending limits and receive alerts to manage their budgets better and avoid unnecessary fees.

How Much Does It Cost To Transfer Money Using Revolut?

Revolut’s money transfer costs depend on whether you’re a personal or business user, and which plan you’re on. If you’re sending money internationally often or running a business that deals in multiple currencies, I think it’s worth looking closely at how fees and allowances change as you move up their pricing tiers.

Personal Customer Pricing

Revolut’s personal plans come with different levels of fee-free international transfers. If you only send money abroad now and then, the free Standard plan might do the job, though you’ll pay full fees on each transfer. But if you send money regularly or in larger amounts, higher-tier plans cut or remove transfer fees entirely.

| Plan | Standard | Plus | Premium | Metal | Ultra |

|---|---|---|---|---|---|

| Monthly Account Fee | Free | £3.99 | £7.99 | £14.99 | £45 (introductory offer) |

| Fair Usage Exchange Limit | £1,000 per month | £3,000 per month | No limit | No limit | No limit |

| Additional Usage Fee | 1% | 0.5% | Free | Free | Free |

| Weekend Exchange Fee | 1% | 1% | 1% | 1% | 1% |

| International Transfer Fee Discount | 0% | 0% | 20% | 20% | 100% |

| Revolut to Revolut Users | Free | Free | Free | Free | Free |

| Local Transfers | Free | Free | Free | Free | Free |

| SEPA Transfers | Free | Free | Free | Free | Free |

| Card Transfers | Fee calculated in real-time | Fee calculated in real-time | Fee calculated in real-time | Fee calculated in real-time | Fee calculated in real-time |

| Other International Transfers | Fee calculated in real-time | Fee calculated in real-time | Fee calculated in real-time | Fee calculated in real-time | Free |

💡 My take? If you’re sending even modest amounts each month, Premium offers a solid middle ground — especially with no FX limits and reduced ATM withdrawal fees. For frequent international transfers, Metal or Ultra may work out cheaper in the long run.

Business Customer Pricing

Business customers pay a monthly fee that gives them a bundle of currency exchange and transfer allowances. All business plans let you send, receive, and exchange in 25+ currencies using local and international details.

| Plan | Basic | Grow | Scale | Enterprise |

|---|---|---|---|---|

| Monthly Account Fee | From £0 | From £19 | From £79 | Custom |

| Monthly Currency Exchange Limit | £1000 per month, then 0.6% after | £10,000 per month, then 0.6% after | £50,000 per month, then 0.6% after | Custom |

| Outside Market Hours Fee | 1% | 1% | 1% | 1% |

| Revolut to Revolut Transfers | Free | Free | Free | Free |

| Local Transfers | 5 free per month, then 20p per additional | 100 free per month, then 20p per additional | 1000 free per month, then 20p per additional | Custom allowance then 20p per additional |

| International Transfers | £5 per transfer | 5 free per month, then £5 per additional | 25 free per month, then £5 per additional | Custom allowance then £5 per additional |

| Card Transfers | Calculated in real-time | Calculated in real-time | Calculated in real-time | Calculated in real-time |

| Guaranteed SWIFT (OUR) | Depends on currency | Depends on currency | Depends on currency | Depends on currency |

| Automated Clearing House (ACH) | 0.2% of the transfer amount charged in GBP or the local currency of the business. Minimum fee of 50p (or equivalent) | 0.2% of the transfer amount charged in GBP or the local currency of the business. Minimum fee of 50p (or equivalent) | 0.2% of the transfer amount charged in GBP or the local currency of the business. Minimum fee of 50p (or equivalent) | 0.2% of the transfer amount charged in GBP or the local currency of the business. Minimum fee of 50p (or equivalent) |

📌 If you’re running a business that trades across borders, I’d suggest starting with Grow — the no-fee transfer allowance and higher FX threshold make it far more cost-efficient than Basic. You can always upgrade if your volumes increase.

What’s The Transfer Process Like?

Using Revolut for money transfers is designed to be as straightforward and efficient as possible. It has an intuitive setup process, clear steps for sending money, and tools to track your transfers. Here’s an overview of the transfer process from start to finish.

1. Sign-Up Process

Signing up for Revolut is quick and easy. Businesses can create an account via the Revolut Business app or website. You’ll need to verify your business after entering your basic details (business name, contact info, etc.). This involves submitting some documents like proof of identity and your company registration. It’s a simple process, but ensuring your business is fully verified before you can start sending money is essential.

Once you’re verified, you’ll have access to a dashboard where you can set up and manage your transfers, track expenses, and access all the features Revolut offers. In my experience, the sign-up is much smoother compared to other platforms, and the whole thing is done digitally, so there’s no paperwork to deal with.

2. Account Manager (for Premium Plans)

If you’re on a higher-tier plan, such as the Scale or Enterprise plan, you’ll be assigned an account manager. This can be incredibly helpful for businesses that need more personalised support. Your account manager can guide you through complex transfers, help you navigate the platform, and answer any questions you may have.

For smaller businesses, Revolut’s customer support will still be available, but it will not be quite the same one-on-one level of service. I think this is an added perk for growing businesses that require more dedicated attention or have frequent international transactions.

3. Making a Transfer

Once your account is set up, making a transfer is straightforward. You simply enter the recipient’s details, the amount, and the currency. Revolut will automatically display the exchange rate (if applicable) and any associated fees before you confirm the transfer.

Revolut uses interbank rates for international transfers, which can save you a lot of money compared to traditional banks. However, there may be a small fee for certain transfers, like weekend exchange rates or exceeding the free allowances, so it’s important to double-check those before proceeding. From what I’ve seen, the process is incredibly smooth—almost like sending money between two bank accounts, but faster and often cheaper.

4. Tracking Transfers

One of the best things about Revolut is the ability to track your transfers in real-time. After you send money, you’ll get instant notifications as your transfer progresses. This transparency can be invaluable for businesses, as it allows you to keep track of your international payments without following up with your bank or waiting around.

In my opinion, the real-time tracking is a standout feature. You’ll always know the exact status of your transfer, from initiation to completion, which gives you peace of mind, especially when dealing with international transactions.

5. Delivery and Receiving Funds

Transfers are usually completed within minutes, especially if you’re sending money to another Revolut account. However, international transfers to non-Revolut accounts can take a few business days, depending on the destination country. Revolut offers fast processing times compared to traditional banks, and the fees are often lower, which makes it a great option for businesses that need quick and reliable transfers.

Revolut Customer Support

Revolut provides efficient, accessible customer support, which is particularly beneficial for businesses managing international transfers. Their support system is well-equipped to handle queries quickly and effectively, which I think is necessary when dealing with time-sensitive transactions.

Revolut’s customer support is available 24/7 through the in-app chat. It’s fast; in my experience, the response time is usually quick for most issues. For businesses on higher-tier plans (like Scale or Enterprise), you also get a dedicated account manager, which is a nice touch for tailored assistance.

For simple inquiries, I’ve found Revolut’s support to be quick, often resolving issues within minutes. It may take a bit longer if you need more in-depth help, but overall, they’re thorough. The in-app chat is generally faster than email support, which is ideal for urgent situations.

Apart from the in-app chat, Revolut has an extensive help centre covering a variety of topics, making it easy to find answers to common questions. You can also escalate issues through email or phone if needed, which adds an extra layer of support.

The support team is generally knowledgeable and provides clear solutions. I’ve found them to be effective, especially when it comes to international transfers. The fact that you can access support anytime is particularly valuable for businesses operating across different time zones.

Revolut Customer Reviews

Revolut tends to divide opinion—but overall, feedback leans positive, especially for speed and convenience. If you value a fast, tech-savvy service that handles international payments smoothly, you’ll likely have a good experience.

On Trustpilot, Revolut scores a solid 4.4 out of 5, based on nearly 200,000 reviews. Many customers rave about quick and easy transfers, especially when sending money to friends or family abroad. I’ve noticed that the real-time updates and intuitive app design are particularly appreciated—they’re often described as seamless, even for users who aren’t especially techy. People also like the low fees and strong exchange rates, which can make a real difference when moving larger sums internationally.

The Google Play and Apple App Store ratings—4.8 and 4.9 out of 5, respectively—paint a similar picture. Users highlight the slick mobile interface, smooth onboarding, and useful extras like saving pockets and multi-currency accounts.

That said, I think it’s important to flag the recurring frustrations. Some users, especially those making more complex or high-value transfers, report issues with account freezes, unclear fees, and unresponsive customer support. A few have described delays in accessing funds and being stuck with automated replies when things go wrong, particularly frustrating when time is critical.

Is Revolut Safe To Use?

When it comes to transferring money, security is non-negotiable, especially for businesses handling large international payments. I understand that you’ll want reassurance about your funds and data safety. Revolut has several advanced security measures to ensure your transfers are safe and compliant.

- Regulation and Licensing: FCA regulation in the UK and EMI license across the EU.

- Advanced Encryption: High-level encryption and two-factor authentication (2FA) for secure logins and transactions.

- Segregated Accounts: Customer funds are kept in segregated accounts for added protection.

- Fraud Prevention Systems: Continuous monitoring for suspicious activity and instant transaction notifications.

- Secure Payment Protocols: Tokenisation for card payments and secure SSL connections.

- Dispute Resolution: Clear process to handle disputes and the potential to reverse payments.

Revolut Recent Updates and Recognitions

Revolut has achieved significant recognition and accolades in the fintech space, particularly for its innovative Money Transfer services, helping to solidify its position as a global leader in digital banking. With over 50 million customers worldwide and 10 million in the UK, Revolut’s rapid growth underscores its impact on the financial landscape.

In 2024, Revolut was awarded a UK banking licence, allowing it to expand its offerings further and operate under enhanced regulatory oversight.

Revolut’s Money Transfer Service was also recognised at the 2024 FS Tech Awards, where it was named Consumer Finance App of the Year. This recognition reflects Revolut’s commitment to providing a seamless, secure, and transparent service for users sending money abroad.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. While we strive to ensure accuracy and up-to-date content, it may not reflect your specific circumstances or the latest developments in financial services.

Before making any financial decisions, including selecting a money transfer service, consult a qualified financial adviser for advice tailored to your needs and situation. Revolut and other services mentioned may not be suitable for everyone, and it is essential to consider all relevant factors, such as fees, exchange rates, and applicable regulations, before proceeding.

Use of this information is at your own risk, and we disclaim any liability for decisions made based on the content provided. Always check the terms and conditions with the service provider before using them.

FAQs

Revolut is a popular and efficient option for transferring money, offering competitive exchange rates, fast transfers, and a user-friendly app. It supports over 30 currencies and 150 countries, making it ideal for international transfers. However, some users have raised concerns about account access issues and customer support. It is a good choice for personal and small-scale transfers but may not be suitable for large or time-sensitive transactions due to occasional service limitations.

Yes, transferring money to Revolut is generally safe. The platform uses strong encryption to protect your personal and financial information and requires biometric or two-factor authentication (2FA) for added security. Revolut also has fraud detection measures, providing real-time notifications to inform users of any suspicious activity.

The duration of a Revolut money transfer depends on the method and destination. Revolut-to-Revolut transfers are instant, while SEPA transfers within the EU are typically processed immediately for smaller amounts but may take up to two business days, depending on the amount or recipient’s bank. Depending on the destination and intermediary banks, SWIFT transfers can take 2-5 business days. Card transfers are usually completed within 30 minutes.

Yes, you can send money internationally with Revolut. The platform supports transfers in over 30 currencies to more than 150 countries. Revolut offers competitive exchange rates, and transfers can be made through various methods, including bank transfers, card transfers, and Revolut-to-Revolut transfers.

Yes, you can transfer large amounts of money using Revolut, but the limits vary depending on the destination, currency, and your Revolut plan. For example, single payments within the UK can go up to £250,000, while SEPA Instant transfers have a limit of €100,000. Monthly limits for foreign currency transfers also depend on your plan: the Plus plan allows up to £3,000, while Premium and Metal plans have no monthly limit. However, certain countries have specific limits, so it’s essential to check the app for any exceptions before making a transfer.