Sending money abroad often involves worrying about hidden fees, slow processing, or complicated paperwork.

As a long-established UK bank, the Royal Bank of Scotland (RBS) offers international payment services designed to streamline these concerns for both personal and business customers.

Drawing on its heritage and robust infrastructure, RBS sets out to provide transparent fees, flexible transfer options, and enhanced security measures.

In this overview, we’ll see how well RBS lives up to those promises and whether it stands out among modern competitors.

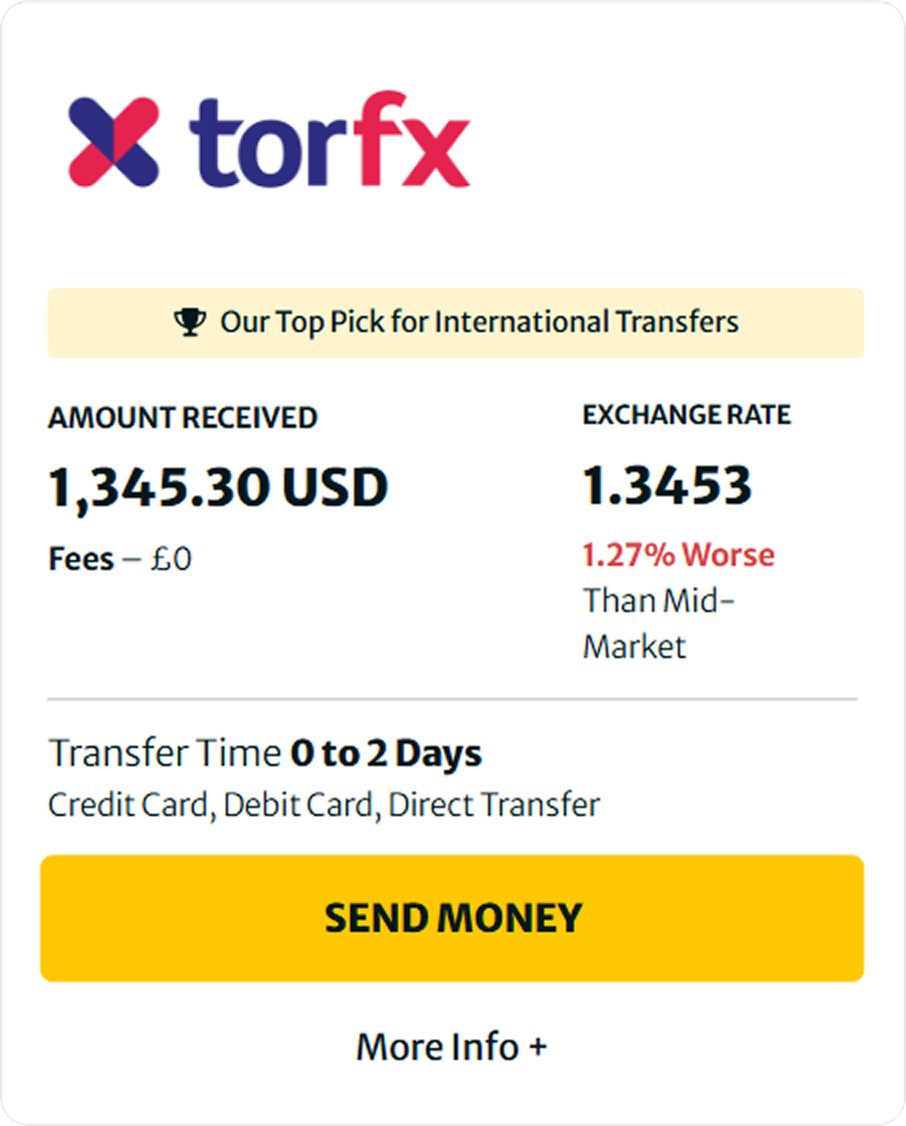

Send Money Smarter With Currency Expert

RBS Money Transfer Key Features

Flexible International Payments

RBS enables you to send funds overseas in a variety of major currencies through your RBS account, making it ideal for both personal remittances and business payments.

Standard transfers are processed free of charge within 2 to 4 working days, offering a cost-effective option for everyday transactions.

If you need funds delivered sooner, the urgent payment option is completed within 1 to 2 working days for a £15 fee, providing the flexibility to meet tighter deadlines.

SEPA Credit Transfers

For those dealing in euros, RBS offers specialised SEPA Credit Transfers that simplify cross-border transactions within the Single Euro Payments Area.

When you initiate a SEPA transfer via Digital Banking before 2 PM GMT, funds are credited on the same business day, ensuring prompt access to your money.

This service is particularly beneficial for businesses and individuals who frequently manage euro payments, as it eliminates extra fees and reduces processing delays.

Live Exchange Rates and Transparent Fees

RBS provides real-time exchange rate information at the moment of your transaction, so you know exactly what conversion you are getting before confirming your payment.

This clarity helps you avoid hidden charges and make informed decisions about the most suitable transfer method.

All costs are clearly displayed, including a £15 fee for urgent transfers and no fee for standard payments, allowing you to balance speed and affordability.

Digital Banking and Payment Tracking

RBS’s Digital Banking platform and mobile app make it easy to initiate, manage, and monitor your international payments from anywhere.

The user-friendly interface guides you through each step, from selecting payees to confirming payment details.

Integrated tracking features provide real-time updates on your transaction’s progress, giving you peace of mind and keeping you fully informed.

Secure Receiving and Regulatory Compliance

RBS not only focuses on sending money but also offers robust services for securely receiving international payments.

Detailed guidelines ensure that essential beneficiary information, such as IBAN and BIC/SWIFT codes, is captured accurately to facilitate smooth transactions.

Advanced security measures, including biometric approvals and strict data protection policies, ensure that your funds and personal data remain safe while meeting rigorous regulatory standards.

RBS International Money Transfer Pricing and Fees

RBS provides a straightforward pricing structure for both personal and business customers, aiming to keep costs transparent. The total cost of an international transfer typically depends on the service type and currency involved:

- Standard Payment: No fee applies, and funds generally arrive within 2 to 4 working days. This option is suitable for routine transactions where speed is not critical.

- Urgent Payment: A £15 fee ensures delivery within 1 to 2 working days. This service is helpful if you need to meet tight deadlines or make time-sensitive payments.

- SEPA Credit Transfers: For euro transactions within the Single Euro Payments Area (SEPA), RBS charges no fee when using Digital Banking. Payments made before 2 PM GMT are credited on the same business day, making this an efficient choice for those frequently dealing in euros.

Exchange rates are provided at the time of your transaction, giving you a clear understanding of conversion costs before confirming.

It’s important to note that intermediary or receiving banks may impose their own fees, which are outside RBS’s control. This transparency helps you assess options and choose the most cost-effective method for your specific needs.

RBS Global Transfer Pros and Cons

| Pros | Cons |

|---|---|

| No fees on standard payments | Urgent transfers cost £15 |

| Transparent real-time exchange rates | Daily transfer limits |

| Same-day SEPA transfers | Additional receiving bank charges |

| Comprehensive online and mobile banking | Must set up new payees via Digital Banking |

| Robust security with biometric approvals | Must have an RBS bank account to make transfers |

RBS Security Measures

RBS places a strong emphasis on safeguarding both personal and financial data.

The bank employs advanced encryption technologies to protect sensitive information during transfers, reducing the risk of interception or unauthorised access. Customers can also enable biometric approvals within the RBS mobile app, ensuring that only verified users can authorise outgoing payments.

Beyond technical protections, RBS follows stringent regulatory standards in every market it operates, including those set by the Financial Conduct Authority. It also adheres to legal requirements and compliance checks that help deter fraud and money laundering.

By combining modern security tools with robust oversight, RBS aims to give customers greater peace of mind when transferring funds across borders.

RBS Customer Feedback

As of January 2025, the Royal Bank of Scotland holds a “Bad” Trustpilot rating of 1.5 out of 5 (244 reviews), indicating some dissatisfaction among users.

In contrast, the RBS mobile app receives higher marks on digital storefronts. It holds a 4.7 out of 5 rating on Google Play (95,800 reviews) and a 4.8 out of 5 rating on the Apple App Store (182,100 reviews).

Many app users praise the intuitive interface and reliable functionality for everyday banking, including international transfers.

Common concerns on that platform include general banking issues and customer service experiences that may not directly reflect international transfer performance.

RBS Recent Updates and Recognitions

Founded in 1727, RBS introduced the overdraft facility in 1728, quickly establishing itself as an innovative force in Scottish banking. Over the centuries, the bank expanded across the UK, acquired NatWest in 2000, and faced challenges during the 2008 financial crisis, eventually returning to private ownership under the NatWest Group by 2025.

In 2023, RBS introduced Tyl (a payment platform for small businesses), extended its sponsorship of Team GB and ParalympicsGB, renewed its partnership with Kiltwalk, and launched the Royal Bank Regenerate Fund with Neighbourly.

During this period, RBS also received recognition for its employment practices and financial education programmes, highlighting a continued commitment to community engagement and responsible banking.

Conclusion

RBS stands out by combining centuries of banking heritage with modern digital innovation, making it a strong choice for customers who value security, transparency, and reliability. Personal users who appreciate the stability of a long-established institution will find comfort in its clear fee structures and robust security measures.

Business customers and those dealing with euro payments also benefit from RBS’s specialised SEPA transfers and same-day processing for urgent payments.

The main down-side is that you have to have an RBS account to make international payments.

In short, if you prefer the trust and stability of a traditional bank paired with a user-friendly digital experience, RBS is well worth considering.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. While we aim to ensure accuracy and relevance, the content may not reflect your specific circumstances or the most current developments in financial services.

Before making any financial decisions, including choosing a money transfer service, you should consult a qualified financial adviser who can provide guidance tailored to your individual needs and situation. Wise and other financial products mentioned in this article may not be suitable for everyone, and it is essential to consider all factors, including fees, exchange rates, and applicable regulations, before proceeding.

The use of this information is at your own discretion, and we disclaim any liability for decisions made based on the content provided. Always verify terms and conditions with the service provider directly.

FAQs

You can add a new payee or update existing details via RBS’s Digital Banking platform. For security reasons, the first setup must be completed online rather than via the mobile app. If you encounter any issues, customer support can guide you through the process.t

Once you confirm an international payment, modifications or cancellations are generally not possible. If you believe an error has occurred, contact customer support immediately with your transaction reference. Prompt action may help resolve the issue if the payment has not yet been processed.

Most international transfers can be managed through the RBS mobile app, which offers a user-friendly interface and real-time tracking. However, for security reasons, the first payment to a new international payee must be set up via Digital Banking. After the initial setup, subsequent transfers can be conveniently handled through the app.

If your payment does not arrive within the expected timeframe, first review any notifications or status updates on your Digital Banking dashboard. If the delay continues, contact RBS customer support with your transaction details for further assistance. They will help you investigate and resolve any issues.

RBS offers support through its comprehensive Digital Banking platform, an online support centre, and dedicated phone services. If you have any questions or encounter difficulties with your international transfers, you can reach out to customer service for prompt help and guidance.