While Airwallex isn’t a traditional money transfer service like Wise or Remitly, it still solves the same core problem: moving money internationally, especially for businesses.

Designed as a borderless business account, Airwallex lets companies collect, hold, and pay in multiple currencies. It offers highly competitive FX rates, no monthly fees, and smart tools like virtual cards and accounting integrations.

If you’re running an Amazon store, paying international suppliers, or managing global cash flow, Airwallex could be a more powerful solution than standard transfer services.

In this review, we’ll explain how Airwallex works, how it compares on fees and features, and whether it’s the right choice for your business’s international payment needs.

Send Money Smarter With Currency Expert

Should You Use Airwallex?

Airwallex is a strong choice for businesses looking to streamline international payments, particularly startups and e-commerce companies. I think it’s a great option if you need to handle multiple currencies with ease and reduce the costs associated with cross-border transactions. The platform’s competitive exchange rates, multi-currency accounts, and quick setup make it a time-saver for global businesses.

Airwallex is easy to sign up for in terms of usability, and the interface is straightforward to navigate once you’re set up. It’s ideal for businesses that need to manage international payments regularly, offering a solid range of features without overwhelming complexity. Additionally, the platform’s commitment to security, via compliance with Australian and UK regulations and 2FA, makes it a reliable choice for protecting sensitive financial data.

However, it’s not without its flaws. I’ve noticed some users report issues with slow customer support and occasional response delays, which could be problematic for businesses needing quick resolutions. The mobile app also has limitations, with certain features only accessible on a desktop. Lastly, some customers have raised concerns about account restrictions, which could be frustrating for businesses needing uninterrupted access to funds.

Airwallex At A Glance

| Feature | Details |

|---|---|

| Best For | Startups, e-commerce, and multi-currency management |

| Key Features | – Multi-currency accounts – International payments – FX and cross-border payments – API integration |

| Pros | – Fast global payments – Easy multi-currency management – Low fees for businesses |

| Cons | – Slow customer support – Limited mobile functionality – Occasional account freezes and restrictions |

| Supported Currencies/ Countries | 20+ currencies, with a focus on APAC, Europe, and the US |

| Customer Support | Available via email and chat (criticism of slow responses and lack of 24/7 support) |

| Security Measures | – Regulatory compliance with Australian and UK authorities – Strong data encryption and 2FA |

| Onboarding Process | Quick and easy sign-up with minimal documentation (but some complaints about verification delays) |

| Mobile App | Available on iOS and Android, but limited functionality for transfers on mobile (App Store ratings high, Google Play low) |

| Pricing | Monthly fee from £19, or £0 if you deposit or hold at least £10,000 a month; fees per transaction (varies by currency and payment method) |

| Transaction Fees | Competitive rates for international payments; varies by currency and volume. |

| Rating | Trustpilot: 3.4/5 (1,684 reviews) Apple App Store: 4.9/5 (601 ratings) Google Play: 2.2/5 (237 reviews) |

Pros & Cons

Pros

✅ Multi-currency accounts

✅ Low FX fees (from 0.5%)

✅ Fast local-like transfers

✅ No monthly or setup fees

✅ Easy batch payments

✅ Xero, Shopify, and Stripe integrations

✅ FCA-regulated and funds safeguarded

Cons

❌ Not for personal use

❌ No in-person or cash services

❌ Some industries are blocked (e.g. gambling, charities)

❌ SWIFT fees on some routes

❌ The Android app is less polished

Who Is Airwallex Best For?

Best For

- UK businesses sending/receiving money internationally

- E-commerce sellers with global customers or suppliers

- Freelancers and agencies invoicing overseas clients

- Startups scaling across multiple currencies

- Finance teams needing bulk payments and Xero integration

- Companies transacting in AUD, USD, EUR, HKD, SGD, etc.

Not Suited To

- Personal users sending money to friends or family

- Businesses needing in-person or branch support

- Cash or cheque-based payment needs

- High-risk or restricted sectors (e.g. adult, gambling, certain NGOS)

- Companies making occasional, low-volume transfers

Airwallex Key Features

Multi-Currency Business Accounts

Airwallex makes it simple to hold and manage different currencies under a single account.

You can open “local” accounts in key currencies like USD, EUR, or GBP, helping you collect payments from overseas clients without extra conversion fees.

Local and Global Transfer Methods

When you’re ready to send money, Airwallex taps into local clearing networks (such as SEPA for Europe or ACH in the US) to reduce both time and costs.

For regions not covered by these networks, SWIFT provides global reach.

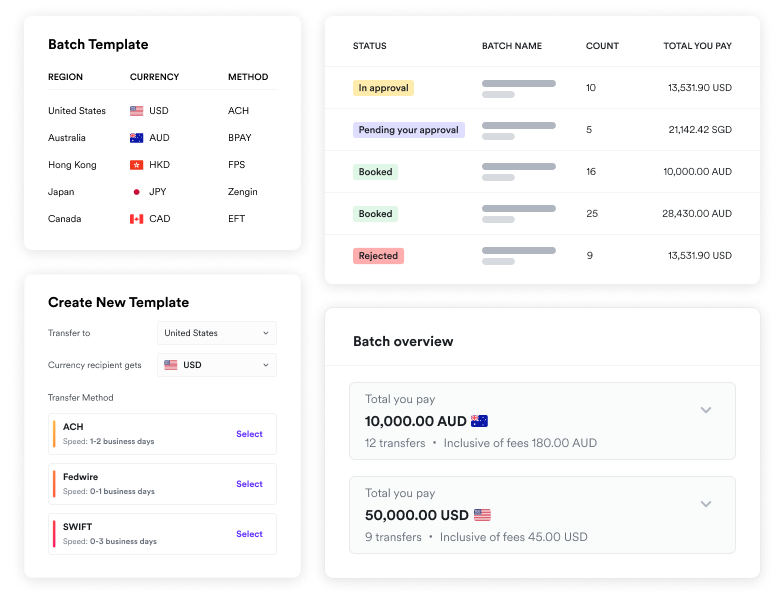

Batch Payments

If you need to pay multiple recipients in one go, Airwallex offers a user-friendly batch tool.

You can upload a single file containing your payees’ details, which streamlines everything from payroll to bulk supplier settlements.

Software Integrations

Seamless integrations with Xero, QuickBooks, and other platforms help you sync transaction details automatically, cutting down manual data entry.

For eCommerce sellers, connections to Shopify or Amazon simplify receiving and reconciling funds.

API and Developer Tools

For businesses wanting more control, Airwallex’s APIs let you build payment workflows tailored to your own systems.

You could automate high-volume cross-border disbursements or create custom processes for your customers; all within a secure environment.

Airwallex Security of Funds

Airwallex does a great job of balancing ease of use with top-notch security. For a platform that serves global businesses, I appreciate how they’ve integrated a range of safeguards without making things overly complicated. It’s not just about compliance—it’s about ensuring that, as a business owner, you feel your funds and data are protected every step of the way.

If you’re handling significant transactions or dealing with multiple currencies, you want to feel confident that your platform is equipped to deal with potential threats. And in my opinion, Airwallex hits that mark.

- Regulatory Compliance

Airwallex is fully regulated by financial authorities in several key regions, including the UK’s Financial Conduct Authority (FCA), ensuring it complies with strict standards. For businesses like yours, Airwallex operates within the boundaries of regulated financial practices, safeguarding your transactions and data. - Data Encryption & Protection

The platform uses end-to-end encryption to protect your sensitive data. So, whether you’re sending payments, managing funds, or accessing reports, your information is kept safe from unauthorised access. - Two-Factor Authentication (2FA)

Airwallex offers two-factor authentication for additional protection. This means that even if someone were to access your login details, they’d still need a second layer of verification to get into your account. It’s a simple step, but it can make a huge difference in preventing fraud. - Segregated Client Funds

Airwallex keeps client funds separate from its operating funds. This is important because it adds an extra layer of protection for your money, reducing the risk of it being used for anything other than your transactions. - Fraud Detection & Monitoring

With advanced fraud detection systems, Airwallex actively monitors transactions in real time for suspicious activity. They look for patterns and flag anything unusual, so your business isn’t exposed to unnecessary risk. - Multi-Layered Security for Payments

When making payments, Airwallex supports 3D Secure (3DS) for online transactions, adding an extra layer of security during payment processing. This is particularly useful when dealing with large, high-value payments or international transactions, where the risk of fraud can be higher.

How Much Does It Cost To Use Airwallex?

Airwallex offers flexible pricing based on your business’s size and complexity. If you’re just starting out or growing steadily, you can get most features without paying a monthly fee, which is a standout. For larger or high-volume businesses, paid plans unlock deeper spend controls, bill pay, advanced reporting, and dedicated support.

I think Airwallex hits a sweet spot for cost-conscious businesses that need international capability without the baggage of big-bank fees. The £0 plan is surprisingly generous, especially if you can meet the £10k deposit/hold threshold. Even the Grow plan feels well-priced considering what you get – expense management, bill pay, and up to 50 cards can really streamline operations.

It’s not the cheapest for card processing – especially outside the UK – but you’re trading a little on fees for a huge gain in flexibility and control.

Here’s a quick look at what you’ll pay – and what you’ll get.

Airwallex Pricing Plans

Monthly fees are VAT-exclusive. 1-month free trial available for Explore and Grow.

| Plan | Monthly Fee | Best For | Key Benefits |

|---|---|---|---|

| Explore | £0 / £19 | Small businesses or startups | £0 if you deposit or hold £10k/month. Global accounts, multi-currency cards, and FX tools |

| Grow | £49 | Scaling teams & spend control | Adds bill pay, expenses, approvals, and more free cards/users |

| Accelerate | £999 | Large businesses | Centralised controls, enterprise integrations, and a dedicated account manager |

| Custom | Custom pricing | High-volume/API-led businesses | Tailored solutions incl. embedded finance and custom API access |

Other Fees To Know About

- FX margin: 0.5% above interbank rate (major currencies), 1% for others

- SWIFT transfers: £10–£20 per transfer

- Fast local transfers: Free for all plans

What’s The Transfer Process Like?

Using Airwallex to send money internationally feels refreshingly modern. The whole experience is designed to be smooth, efficient, and—most importantly—stress-free.

Signing up is straightforward, and once you’re verified, you get access to a genuinely intuitive dashboard. There’s none of that clunky banking logic you often get with legacy platforms. Everything’s where you’d expect it to be.

I think one of the strongest parts of Airwallex’s platform is how clearly it’s been built for global businesses. Whether you’re making one-off supplier payments or managing high-volume international payroll, the interface makes complex things feel simple. You can add funds in multiple currencies, hold balances, set up approvals, manage user permissions, and make payments across 150+ countries—all from the same place.

Once you’re in the dashboard, sending money is just a few clicks. There’s no guesswork around exchange rates—they show you exactly what you’re getting, including the margin. It’s fast, too. Most payments to major markets like the US, EU or Australia land on the same day or next, and that reliability genuinely reduces stress when you’re on a deadline.

There’s a professional polish to how everything works. You can set payment workflows, upload bulk transfers, and create multi-user access controls without needing to call support. That kind of autonomy matters, especially when managing risk or working across time zones.

Customer Support and Service Style

Airwallex doesn’t feel like one of those platforms where you’re left chasing chatbots or sitting on hold. The support is sharp, responsive, and very much geared towards business users who don’t have time to waste.

I think what stands out most is the proactive style—you’re not just getting replies; you’re getting real guidance. Whether it’s a question about setting up multi-currency wallets, bulk payments, or compliance documentation, the support team knows what they’re doing and answers feel tailored, not templated.

You can get help through live chat, email, or a dedicated account manager if you’re handling larger volumes. For growing businesses or teams with more complex needs, having that kind of structured, human support makes a real difference. It’s not just about fixing problems—it’s about helping you get the most out of the platform.

The tone is professional but approachable. There’s none of the stiff, corporate script-reading you sometimes get with banks. If you’re navigating regulation-heavy regions or need help understanding settlement times, they’ll walk you through it without overcomplicating anything.

I found it reassuring that Airwallex takes regulatory compliance seriously but balances that with user-first service. You feel looked after without being micromanaged—ideal if you value autonomy but still want a safety net when needed.

For business users moving large sums across borders, partnership-style support is not only helpful but essential.

Airwallex Customer Feedback

Airwallex receives mixed reviews, with positives and areas for improvement standing out. It holds a 3.4/5 rating on Trustpilot based on 1,684 reviews, showing solid satisfaction but with room for improvement.

Positive Feedback

Many users praise Airwallex’s efficiency, particularly for international payments and multi-currency management. The easy setup and fast processing are commonly highlighted, with several reviewers noting the lack of withdrawal restrictions. Support is often described as responsive, especially for troubleshooting, and the platform is generally seen as reliable for businesses scaling globally. The Apple App Store also reflects this positive sentiment with a 4.9/5 rating.

Negative Feedback

However, customer support has received criticism, particularly around slow response times and a lack of 24/7 support. Some users have complained about unexpected fees, account freezes, and issues with mobile app functionality. Google Play Store reviews notably reflect dissatisfaction, giving it just 2.2/5 stars. Security concerns and unclear documentation requirements were also raised.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. While we aim to ensure accuracy and relevance, the content may not reflect your specific circumstances or the most current developments in financial services.

Before making any financial decisions, including choosing a money transfer service, you should consult a qualified financial adviser who can provide guidance tailored to your individual needs and situation. Wise and other financial products mentioned in this article may not be suitable for everyone, and it is essential to consider all factors, including fees, exchange rates, and applicable regulations, before proceeding.

The use of this information is at your own discretion, and we disclaim any liability for decisions made based on the content provided. Always verify terms and conditions with the service provider directly.

FAQs

Yes, Airwallex offers a mobile app that lets you view balances, send transfers, and monitor transactions on the go. This can be handy if you need to authorise payments or track incoming funds outside the office.

In most cases, you don’t pay monthly subscription or account maintenance fees. You’ll only be charged when you send or convert money, and the exact costs appear upfront so you’re never left guessing.

By default, the smallest conversion is set at $10 USD, while the largest is $5,000,000 USD. If you need to go higher, Airwallex can usually raise that limit once you contact their support team.

Some businesses with higher transaction volumes can request a more personalised service plan. If your needs are simpler, the standard support channels and online help centre are typically enough.

The onboarding process is mostly digital, so it can wrap up within days depending on your documentation. Once approved, you can start making and receiving payments straight away.