Since 1993, XE has grown from a basic currency conversion tool into one of the most trusted names in international money transfers. Its journey reflects a commitment to clarity, reliability, and global access.

Today, XE supports transfers to more than 200 countries through a fully regulated network of partners and handles over $129 billion in transactions each year.

Whether you’re investing in property abroad or managing payroll across borders, XE offers competitive exchange rates and fast, dependable service.

In this review, we take a clear-eyed look at what XE gets right, where it could do better, and why it continues to be a preferred choice for both individuals and businesses.

- Should You Use XE?

- XE Money Transfer At A Glance

- XE Money Transfer Pros & Cons

- Who Is XE Best For?

- XE Money Transfer Key Features

- Send Money to 200+ Countries in 130+ Currencies

- Competitive Exchange Rates & Transparent Fees

- Multiple Payment Methods

- Fast & Reliable Transfers

- Live Market Insights & Currency Tools

- Flexible Receiving Options

- Business Payments & FX Risk Management

- 24/5 Customer Support & Account Management

- User-Friendly Mobile App & Online Platform

- How Much Does It Cost To Use XE Money Transfers?

- What’s The Transfer Process Like?

- Customer Support

- XE Customer Reviews

- Is XE Safe To Use?

- XE Recent Updates and Recognitions

- Disclaimer

Send Money Smarter With Currency Expert

Should You Use XE?

If you’re looking for a reliable and secure way to transfer money internationally, XE is worth considering for everyday use. With a Trustpilot rating of 4.3 out of 5 and strong 4.8 out of 5 scores on both the Apple and Google Play stores, many users appreciate its user-friendly interface, competitive exchange rates, and generally smooth transactions. The mobile app stands out in particular, offering a simple way to manage transfers on the go.

XE is fully FCA regulated, and the absence of hidden fees gives it an edge over traditional banks. However, it may not be the most competitive choice for large or urgent transfers. Some users report delays, especially with high-value payments or when sending money over weekends, which could be a concern if timing is critical.

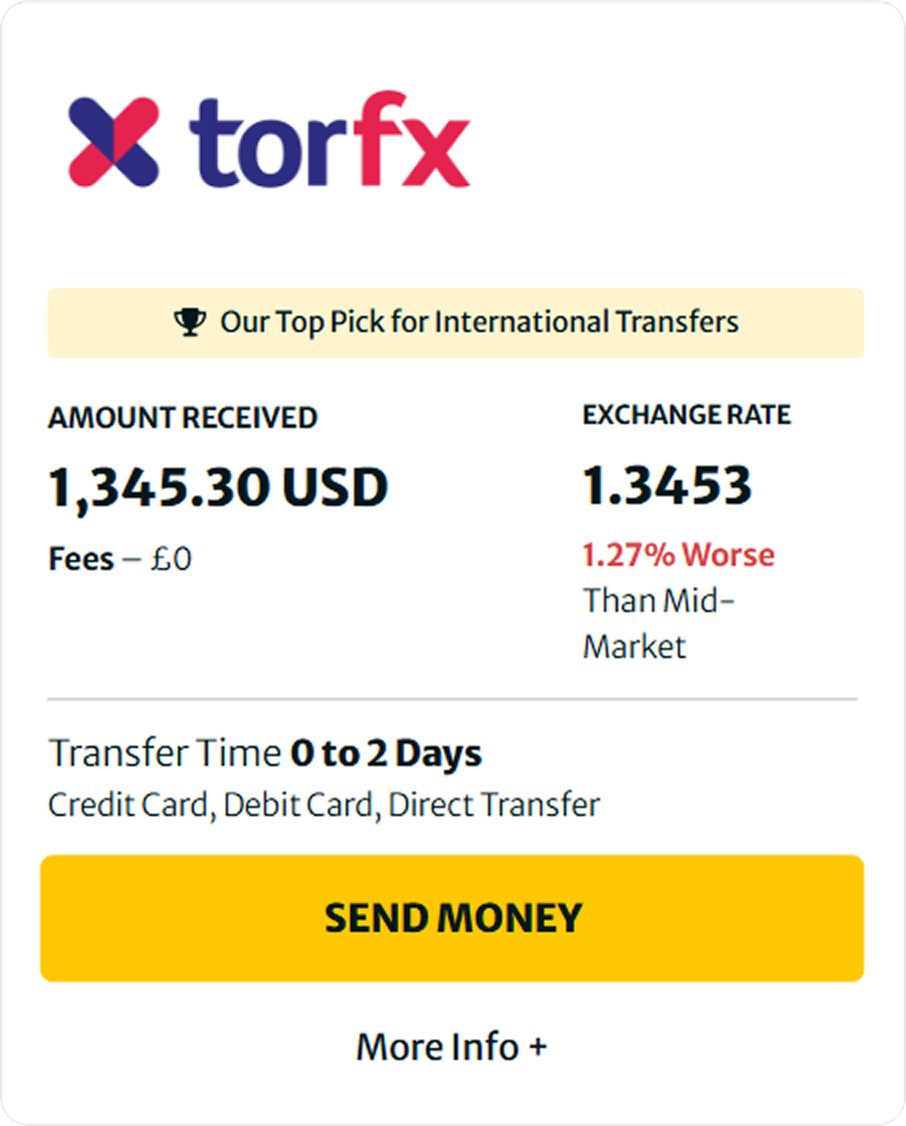

One of XE’s strengths is its real-time exchange rates, which can help users get a fair deal. That said, if you need 24/7 support or absolute clarity on fees and third-party charges, XE’s customer service may fall short. For larger transfers, or if personalised service is a priority, providers like TorFX or Currencies Direct may offer better overall value.

XE Money Transfer At A Glance

| Feature | Details |

|---|---|

| Best For | High-value international transfers, regular personal/business use |

| Not Ideal For | Urgent weekend transfers, users needing fast support or total fee clarity |

| Trustpilot Rating | 4.3 out of 5 (77,645+ reviews) – Reliable but with some customer service concerns |

| App Store Ratings | 4.8 (iOS) / 4.8 (Android) – Fast, simple, and well-rated mobile experience |

| Transfer Speed | Same-day to 2 business days (varies by currency & bank) |

| Fees | £0 fee for most transfers; third-party bank fees may apply |

| Exchange Rates | Competitive, live market rates with small margin added |

| Minimum Transfer | No minimum |

| Maximum Transfer | Up to £350,000 online (higher limits via account manager) |

| Payment Methods | Bank transfer, debit/credit card, Apple Pay (UK only) |

| Customer Support | Phone and email (weekdays); mixed reviews on responsiveness |

| FCA Regulated? | Yes – XE is authorised by the Financial Conduct Authority in the UK |

XE Money Transfer Pros & Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Competitive Real-Time Exchange Rates | Card Payments Have Fees |

| No transfer fees on most major currencies | Transfers to Some Countries May Take up to 3-4 business days. |

| Fast Transfers | No In-Person Customer Service |

| Multiple Payment & Receiving Methods | Limited Support for Exotic Currencies |

| Secure & Financial Conduct Authority-Regulated | No Weekend Transfers |

| Business-friendly features, including forward contracts, limit orders, and API integrations. | You have to sign up to see live rates — not ideal for quick comparisons |

| Supports 200+ countries and 130+ currencies | |

| 24/5 Customer Support |

Who Is XE Best For?

Who XE is Best For

- Individuals making large, one-off transfers – If you send £10,000 or more (say, for a property purchase abroad), XE’s exchange rates become much more attractive.

- Expats and international professionals – I think XE works well if you need to move funds between countries.

- People who want support on standby – 24/7 phone access isn’t something all providers offer, and it’s a big plus when large amounts are involved.

- Users focused on security – XE’s long track record, FCA regulation, and global licensing add a strong layer of reassurance.

Who XE Isn’t Ideal For

- People sending smaller sums – Under around £2,000, the rates just aren’t as competitive. Others will likely give you better value.

- Anyone needing fast delivery to cash or mobile wallets – XE doesn’t offer these payout options, so if that’s your priority, I’d look elsewhere.

- Frequent travellers or remote workers – There’s no multi-currency account or card to hold or spend in different currencies.

XE Money Transfer Key Features

Send Money to 200+ Countries in 130+ Currencies

XE enables seamless international money transfers for both personal and business users, covering over 200 countries and supporting 130+ currencies. Whether paying overseas tuition fees, buying property abroad, or managing cross-border business expenses, XE provides a secure and efficient way to send money globally.

Competitive Exchange Rates & Transparent Fees

XE offers real-time, bank-beating exchange rates with complete transparency. The rate you see when confirming your transfer is the rate you’ll get—no hidden markups. Fees vary depending on the transfer method and destination, but XE clearly displays costs upfront before you send money. Large transfers often benefit from lower fees, making it a cost-effective option for high-value transactions.

Multiple Payment Methods

Customers can fund their transfers using the following:

- Bank transfer – A cost-effective method with no card processing fees.

- Debit or credit card – The fastest option, with most transfers completed in minutes.

- Wire transfer – A reliable option for high-value transactions, usually processed within 24 hours.

- Direct Debit (ACH in the US) – A convenient way to automate payments.

Fast & Reliable Transfers

90% of transfers arrive within minutes, especially when funded via debit or credit card. Bank and wire transfers typically take 1-3 business days, but some recipient banks may take longer. XE provides real-time tracking so users always know where their money is and when it will arrive.

Live Market Insights & Currency Tools

XE goes beyond money transfers by offering a suite of currency tools:

- Live exchange rates – Monitor over 100 currency pairs in real-time.

- Rate alerts – Set notifications for specific exchange rate targets.

- Historical exchange rates – Analyse trends over days, weeks, or years.

- IBAN calculator – Ensure accurate international bank account details for seamless transactions.

- Daily currency news & updates – Stay informed on market trends with XE’s expert insights.

These features help individuals and businesses time their transfers for the best exchange rates.

Flexible Receiving Options

Recipients can receive money in multiple ways:

- Bank deposit – Funds are sent directly to the recipient’s account, usually within 1-3 business days.

- Mobile wallet – Available in 35+ countries, allowing recipients to access funds instantly on their phone.

- Cash pickup – Money can be collected at 500,000+ locations worldwide, providing flexibility for those without a bank account.

Business Payments & FX Risk Management

For businesses handling frequent international transactions, XE offers:

- Forward contracts – Lock in exchange rates for up to 24 months to mitigate currency risk.

- Limit orders – Automatically process a transfer when the desired exchange rate is met.

- XE Currency API – Integrate real-time exchange rates and automated transfers directly into business systems.

- Mass payments – Process high-volume international payments quickly and efficiently.

These features help SMEs and larger businesses manage costs, improve cash flow, and reduce exposure to currency fluctuations.

24/5 Customer Support & Account Management

XE offers personalised support with dedicated account managers for high-value transfers or complex business needs. Standard customer service is available via:

- Live chat

- Phone support

- Email inquiries

- Help Centre & FAQs

XE’s live chat feature provides real-time assistance for urgent issues, ensuring a smooth transfer experience.

User-Friendly Mobile App & Online Platform

XE’s digital platform makes it easy to manage money transfers anywhere, anytime. Key features include:

- Instant quotes & secure transfers in a few taps.

- Transfer tracking & real-time updates on the status of your funds.

- Customisable dashboards for businesses to manage multi-currency transactions.

- Market analysis & alerts to stay ahead of currency movements.

The XE app is available for iOS and Android, ensuring users can confidently transfer money on the go.

How Much Does It Cost To Use XE Money Transfers?

XE doesn’t charge a fixed transfer fee on most international payments, which looks great at first glance. But the real cost is baked into the exchange rate margin, the small percentage they add on top of the mid-market rate when converting your money.

For larger transfers (£10k+), XE’s pricing becomes genuinely competitive. But the margin feels a bit steep for smaller amounts, especially when others offer flat fees or near-zero markups.

Here’s what you’ll typically pay:

| Transfer Amount | Exchange Rate Margin (Approx.) |

|---|---|

| Under £5,000 | 1.0% to 1.5% |

| £5,000 – £50,000 | 0.5% to 1.0% |

| £50,000+ | 0.3% to 0.7% |

These rates vary by currency pair and destination, so I recommend checking a live quote before committing.

What’s The Transfer Process Like?

Getting started with XE is fairly painless. Signing up only takes a few minutes. You’ll need to provide basic ID and proof of address for verification, which is standard for any FCA-regulated provider. I found the process smooth, and once you’re verified, you can start transferring immediately.

The transfer flow is intuitive and straightforward. You choose the currencies, enter the amount, and XE gives you a live exchange rate quote. What I liked is that they lock in the rate the moment you confirm, so there’s no nasty surprises if the market shifts. You’ll then fund the transfer via bank transfer or debit card, depending on what’s available in your country.

Transfers are tracked in real time from your XE dashboard. You get updates by email, and I found the notifications timely and reassuring, especially for larger sums. Most payments land within 1–2 working days, although the exact speed depends on the destination and receiving bank.

Their platform works well across web and mobile. Account management is straightforward: You can view your transfer history, add recipients, or set up rate alerts if you’re holding out for a better deal. The app could feel a bit dated compared to newer players, but it does the job.

Customer Support

XE offers a mix of phone and email support, with local phone lines in several countries. That’s handy if you’re dealing with high-value transfers and want to speak to someone directly. I think this sets XE apart from more app-only providers – sometimes you just need a real human to reassure you when large sums are moving internationally.

That said, response times can vary. Customers state that phone support is quick to pick up and the staff is knowledgeable, especially helpful when they had questions about transfer times and verification documents. Email replies took a bit longer, but customers still got a clear answer within a day.

XE doesn’t offer 24/7 support, which is worth noting if you’re moving money across time zones or need assistance outside business hours. There’s also no live chat, which is something I missed, as it’s useful for quick questions.

XE Customer Reviews

Overall, XE receives a lot of praise—and a fair bit of critique, too. I’ve dug into thousands of reviews to get a balanced picture, and here’s what stands out for me.

The good

XE scores 4.3 out of 5 on Trustpilot from over 77,000 reviews, which shows a solid level of trust. Most people highlight the same strengths: fast transfers, decent exchange rates, and an easy-to-use platform. I think adding features like Apple Pay and one-day turnaround times is a real plus for anyone sending money regularly. Account managers also get positive mentions, especially for providing tailored, human support—something that matters if you’re moving larger sums.

Mobile users are particularly happy. XE’s app has 4.8 stars on both the App Store and Google Play, and reviews often mention its clean design, reliability, and better rates than high-street banks. I’d say if you want something convenient and dependable from your phone, this ticks the box.

The not-so-good

That said, it’s not all smooth sailing. Some users report long delays—up to 10 days in a few cases—which could be frustrating if you’re moving money for a time-sensitive deal. There are complaints about hidden fees, unclear communication during hold-ups, and trouble reaching customer support, especially over weekends.

Others raise red flags around data privacy, particularly using Plaid for bank access and unexplained account closures, even after verification. That’s worrying if you rely on XE as a business tool.

Is XE Safe To Use?

I think XE strikes a strong balance between usability and safety. It doesn’t overwhelm you with security steps, but it doesn’t cut corners either. For high-value transfers, that’s exactly what you want: straightforward, secure, and compliant.

Here’s what’s in place:

- Regulated globally – XE is authorised by the Financial Conduct Authority (FCA) in the UK and other major regulators worldwide. That means it must meet strict financial, legal, and operational standards.

- Segregated accounts—Your funds are held separately from XE’s business accounts. Even if the company were to fail, your money would still be protected.

- Bank-level encryption—All data is encrypted using 256-bit SSL, the same security standard used by leading banks.

- Two-factor authentication (2FA) adds an extra layer of security when you log in or approve transfers.

- Fraud monitoring – XE actively monitors for suspicious activity, which helps prevent scams or unauthorised access.

XE Recent Updates and Recognitions

In 2015, XE was acquired by Euronet Worldwide (NASDAQ: EEFT), a move that expanded its global presence and significantly enhanced its money transfer capabilities. This partnership allowed XE to tap into Euronet’s extensive financial network, enabling faster and more secure international transfers.

Three years later, in 2018, XE merged with HiFX, consolidating two major players in the international payments space under the XE brand. This merger streamlined services for both personal and business users, offering more flexible foreign exchange solutions and a more seamless payment experience.

Disclaimer

The content in this article is provided for general informational purposes only and does not constitute professional financial advice. While we strive to ensure the information is accurate and up-to-date, it may not fully reflect your circumstances, the latest financial regulations, or service changes.

Before making any decisions, particularly regarding money transfer services, we recommend seeking advice from a qualified financial professional who can offer guidance based on your needs. XE and other services discussed in this review may not be appropriate for all users, so it’s essential to consider all relevant factors, including fees, exchange rates, and applicable regulations.

You are solely responsible for any decisions made based on the information provided, and we disclaim any liability for actions taken. Always review terms and conditions directly with the service provider.

FAQs

With its regulated network and transparent fees, XE is a solid choice for both personal and business transactions. XE’s features, such as forward contracts and real-time tracking, can be particularly beneficial for large or frequent transfers. However, it’s essential to consider factors like potential fees for card payments and transfer times to certain countries before deciding.

Yes, the Financial Conduct Authority (FCA) regulates XE in the UK, ensuring it complies with strict financial regulations to protect customers. This oversight guarantees that XE meets high security, transparency, and consumer protection standards when facilitating money transfers.

The maximum transfer limit on XE varies depending on the transfer method, payment method, destination country, and currency. For example, for personal customers in the UK, the online transfer limit is £350,000 or the equivalent in the sending currency. Similarly, business customers can send up to $15 million USD daily via wire transfer. For larger transfers, it’s best to contact XE customer support directly.

No, you don’t need an XE account to receive money. XE offers flexible receiving options, allowing recipients to receive funds via bank deposit, mobile wallet, or cash pickup at locations worldwide. As long as the sender provides the correct details, you can receive your transfer without creating an XE account.

XE generally offers no transfer fees for bank and wire transfers, but fees may apply for certain payment methods, such as credit or debit card transactions. The cost of a transfer mainly depends on the amount being sent, the payment method chosen, and the destination country. XE provides full transparency by displaying all fees upfront before confirming the transfer.