While Airwallex isn’t a traditional money transfer service like Wise or Remitly, it still solves the same core problem: moving money internationally, especially for businesses.

Designed as a borderless business account, Airwallex lets companies collect, hold, and pay in multiple currencies. It offers highly competitive FX rates, no monthly fees, and smart tools like virtual cards and accounting integrations.

If you’re running an Amazon store, paying international suppliers, or managing global cash flow, Airwallex could be a more powerful solution than standard transfer services.

In this review, we’ll explain how Airwallex works, how it compares on fees and features, and whether it’s the right choice for your business’s international payment needs.

Airwallex Key Features

Multi-Currency Business Accounts

Airwallex makes it simple to hold and manage different currencies under a single account.

You can open “local” accounts in key currencies like USD, EUR, or GBP, helping you collect payments from overseas clients without extra conversion fees.

Local and Global Transfer Methods

When you’re ready to send money, Airwallex taps into local clearing networks (such as SEPA for Europe or ACH in the US) to reduce both time and costs.

For regions not covered by these networks, SWIFT provides global reach.

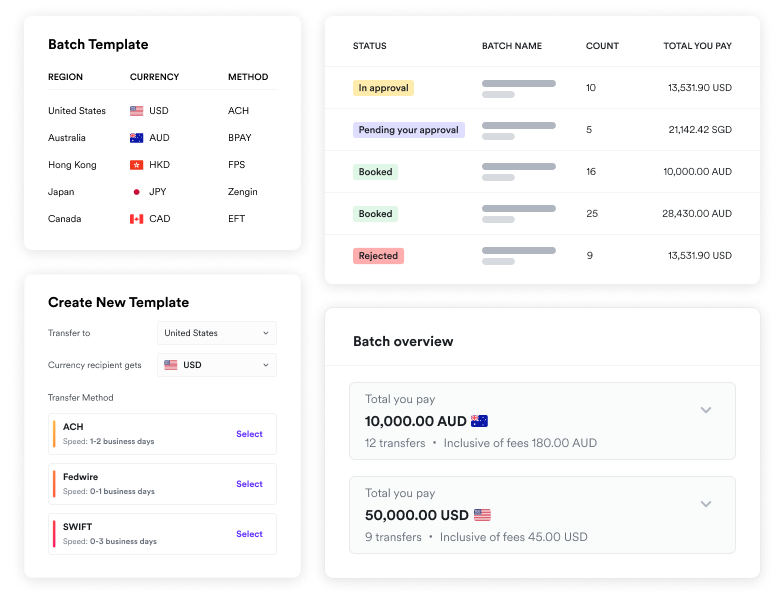

Batch Payments

If you need to pay multiple recipients in one go, Airwallex offers a user-friendly batch tool.

You can upload a single file containing your payees’ details, which streamlines everything from payroll to bulk supplier settlements.

Software Integrations

Seamless integrations with Xero, QuickBooks, and other platforms help you sync transaction details automatically, cutting down manual data entry.

For eCommerce sellers, connections to Shopify or Amazon simplify receiving and reconciling funds.

API and Developer Tools

For businesses wanting more control, Airwallex’s APIs let you build payment workflows tailored to your own systems.

You could automate high-volume cross-border disbursements or create custom processes for your customers; all within a secure environment.

Airwallex Security of Funds

Airwallex is regulated by the UK’s Financial Conduct Authority (FCA) and other global bodies, so it must follow strict rules to safeguard your money.

Your balance is kept in segregated accounts at top-tier banks, away from Airwallex’s operational funds, while SSL encryption and two-factor authentication (2FA) protect your account behind the scenes.

Their 24/7 monitoring team will step in in case of unusual activity, which is essential if you’re sending especially large amounts. Although these checks can cause a short delay, they’re a small trade-off for peace of mind.

If you’re worried about exact transfer timings or fluctuating exchange rates, chat with a financial adviser to make sure all your bases are covered.

Airwallex Fees & Pricing

Airwallex’s biggest advantage for international transfers is that it often uses “local” routes in the recipient’s country to deliver funds, even though you’re sending money from abroad.

Essentially, you deposit your currency (e.g., GBP or EUR) into your Airwallex account, convert it at near-interbank rates, and then Airwallex pays out locally on the other side.

The process still counts as an international transfer for you, but the recipient sees it as a domestic deposit; helping cut costs and speed up delivery.

Here’s a simplified look at typical cross-border fees (charged in USD when your transfer arrives in the local currency):

- To the US (in USD)

- ACH: $2.00

- Fedwire (SWIFT): $10.00

- To China (in CNY)

- Local payout: 0.10% of the amount

- To SEPA countries (in EUR)

- Local payout: $2.00

- To Australia (in AUD)

- Bank transfer: $2.00

- Foreign Exchange Margin

- 0.5% on major currencies (GBP, EUR, USD, AUD, HKD, CNY)

- 1% on others

While these figures can shift slightly depending on currency routes, Airwallex displays the exact cost before you confirm. If you’re moving very large sums, always check with a professional adviser first; planning your timing and exchange rate can make a meaningful difference to your bottom line.

Pros & Cons

Pros

✅ Robust Security: Fully regulated, with segregated accounts to protect large sums.

✅ Near-Interbank Rates: Low currency markups for key currencies.

✅ Fast Delivery: Funds typically arrive within one business day for major corridors.

✅ Batch Transfers: Send mass payments in a single upload.

✅ Seamless Integrations: Receive funds directly from PayPal, Shopify, Stripe, eBay, Klarna, Afterpay, and more.

Cons

❌ Business-Only: Not available for personal transfers.

❌ Industry Restrictions: Gambling, charities, and certain high-risk sectors aren’t supported.

❌ SWIFT Reliance: Some routes still use SWIFT, adding fees or slight delays.

❌ No Cash Handling: Digital-only—no branches or in-person deposits.

Airwallex Customer Feedback

On Trustpilot, Airwallex has an “average” rating of 3.5/5 from 1,670 reviews. Over on Google Play, the app sits at 2.2 out of 5 from 226 reviews. Meanwhile, the Apple App Store rating is notably higher at 4.9 out of 5 from 578 ratings.

Many businesses praise the simplicity of setting up multi-currency accounts and the speed with which cross-border transfers reach recipients, even for large sums. One reviewer noted that funds arrived “almost like a local bank transfer,” while another mentioned the platform’s intuitive navigation and transparent fees.

Some users do point out that Airwallex is not designed for personal transfers and wish there were easier onboarding options for smaller-scale needs.

Still, most feedback focuses on reliability and the helpfulness of the support team, suggesting that if your business relies on secure, quick transfers, Airwallex can be a strong contender.

Recent Updates & Recognitions

Airwallex has steadily expanded its global network, now supporting payouts to more than 150 countries and territories while introducing additional local clearing options.

They recently launched new integrations with leading eCommerce and accounting platforms, simplifying businesses’ consolidation of financial operations. These enhancements reflect Airwallex’s ongoing commitment to streamlining cross-border transactions and ensuring users can manage complex financial flows in one place.

In addition, Airwallex continues to gain industry recognition for its secure infrastructure and innovative approach to global payments. Industry experts frequently praise its seamless blend of fast local payouts and competitive exchange rates, and the company has won awards for customer service and fintech excellence.

It all underscores Airwallex’s status as a rising star in cross-border money transfers, demonstrating that user-friendly design and rigid compliance can go hand in hand.

Conclusion

Airwallex is a smart choice if you’re running a globally facing business and need more than low-cost transfers.

Compared to platforms like Wise or Payoneer, it offers a deeper feature set for managing international cash flow, including multi-currency wallets, free local accounts in key markets, batch transfers, and strong accounting integrations.

Unlike Wise, which is brilliant for simple payments but limited in business infrastructure, Airwallex acts as a full business account with more control over how and when funds are moved. Another point of comparison is that while Payoneer is popular for receiving payments from platforms like Amazon or Upwork, Airwallex often beats it on FX rates and offers a more modern interface with no monthly fees.

Where Airwallex really shines is in supporting high-volume businesses: eCommerce operators, Amazon sellers, or companies paying overseas teams can benefit from lower FX costs, streamlined payments, and automated workflows. If that’s you, Airwallex could offer a more scalable solution than any of the more “consumer-first” alternatives.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. While we aim to ensure accuracy and relevance, the content may not reflect your specific circumstances or the most current developments in financial services.

Before making any financial decisions, including choosing a money transfer service, you should consult a qualified financial adviser who can provide guidance tailored to your individual needs and situation. Wise and other financial products mentioned in this article may not be suitable for everyone, and it is essential to consider all factors, including fees, exchange rates, and applicable regulations, before proceeding.

The use of this information is at your own discretion, and we disclaim any liability for decisions made based on the content provided. Always verify terms and conditions with the service provider directly.

FAQs

Yes, Airwallex offers a mobile app that lets you view balances, send transfers, and monitor transactions on the go. This can be handy if you need to authorise payments or track incoming funds outside the office.

In most cases, you don’t pay monthly subscription or account maintenance fees. You’ll only be charged when you send or convert money, and the exact costs appear upfront so you’re never left guessing.

By default, the smallest conversion is set at $10 USD, while the largest is $5,000,000 USD. If you need to go higher, Airwallex can usually raise that limit once you contact their support team.

Some businesses with higher transaction volumes can request a more personalised service plan. If your needs are simpler, the standard support channels and online help centre are typically enough.

The onboarding process is mostly digital, so it can wrap up within days depending on your documentation. Once approved, you can start making and receiving payments straight away.