When sending money abroad, it should be quick, easy, and secure — and that’s exactly what Profee offers.

With no hidden fees, fast transfers, and an intuitive mobile app, Profee aims to make international money transfers simple and stress-free.

Whether you’re supporting family overseas or covering unexpected expenses, Profee provides a reliable, cost-effective solution.

In this review, we’ll examine the features, benefits, and customer feedback to help you decide if Profee is the right choice for your money transfer needs.

- Should You Use Profee?

- Profee At A Glance

- Profee Pros and Cons

- Who Is Profee Best For?

- Profee Key Features

- What’s The Transfer Process Like?

- Getting Started Is Quick (Almost Too Quick)

- Clean, Minimal Interface

- Making a Transfer

- Speed & Notifications

- Managing Your Account

- How Much Does Profee Cost?

- Customer Support and User Experience

- Profee Customer Reviews

- Is Profee Safe To Use?

- Profee Recent Updates and Recognitions

- Disclaimer

Send Money Smarter With Currency Expert

Should You Use Profee?

If security is your top concern—as it should be—Profee offers a solid foundation of trust. It’s regulated by the Central Bank of Cyprus and authorised under EU law, so your money and data are protected by strict compliance standards. That’s especially reassuring if you’re sending money to countries that are sometimes harder to reach through traditional providers.

That said, Profee isn’t right for everyone. It’s ideal if you’re comfortable using a mobile app and want low fees, fast transfers (sometimes in minutes), and support for card-to-card payments. For regular payments to Russia, Ukraine, or Eastern Europe, it’s a popular choice. Many users praise how fast and easy it is, especially with options like Apple Pay.

However, if you need face-to-face customer service, or you’re planning to send large amounts and want that extra human reassurance, you might prefer a provider with more comprehensive support. Some users also mention inconsistent experiences when things go wrong.Overall, I think Profee is best for cost-conscious users who want speed, simplicity, and solid regulation—but only if you’re happy managing your transfers entirely online and don’t need extras like cash collection or tailored support.

Profee At A Glance

| Feature | Details |

|---|---|

| Best For | Fast card-to-card transfers to supported countries |

| Not Ideal For | Cash pick-up needs, large one-off transfers, or if support access is crucial |

| Trustpilot Rating | 4.4 / 5 (5,776 reviews) – generally positive, especially for speed & value |

| Transfer Speed | Instant to a few minutes (typical), but delays reported in some cases |

| Transfer Fees | Often free for new users; otherwise, low-cost, but fees vary by route |

| Exchange Rates | Competitive – often better than banks, though some users find them unclear |

| Supported Countries | 45+ countries, with strong support for Eastern Europe (e.g. Russia, Ukraine) |

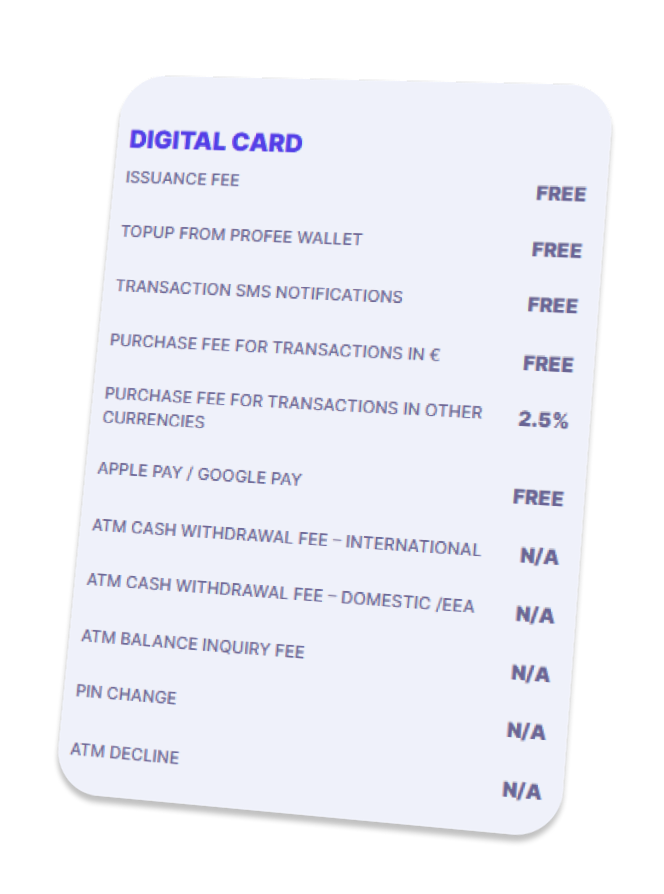

| Payment Methods | Debit card, credit card, Apple Pay, Google Pay |

| Payout Methods | Direct to bank account or card – no cash pick-up |

| Mobile App Ratings | iOS: 4.8 / 5 (479 ratings) • Android: 4.3 / 5 (9,000+ ratings) |

| Verification Requirements | ID verification often required; can request documents from both parties |

| Customer Support | Email & in-app chat • Mixed reviews: helpful but sometimes slow or unclear |

| Regulation & Safety | EU-authorised (Bank of Lithuania), PCI DSS certified, encryption in place |

Profee Pros and Cons

| ✅ Pros | ❌ Cons |

|---|---|

| Transfers usually land within minutes | No cash pick-up service |

| Zero fees on your first transfer | Can’t send to every country |

| No hidden charges – what you see is what you pay | Maximum annual transfer limit of €100,000 (approx. £83,660) |

| Strong exchange rates, especially on promo routes | Must verify identity to send more than €1,000 (approx £836) |

| Send money direct to cards or bank accounts – no sign-up needed for recipients | Identity checks can feel over the top at times |

| App is slick, fast, and easy to use | Refunds or failed transfers can take time to sort out |

| Lots of payment options, including Apple Pay and Google Pay | |

| SEPA and Sofort make it great for EU-based users | |

| 7-day customer support in multiple languages | |

| High security standards with two-step verification |

Who Is Profee Best For?

Best for

- People sending regular low-to-mid value transfers to family or friends in Europe, Asia, or CIS countries

- Anyone who wants fast delivery straight to a card or bank, with no hassle on the recipient’s end

- users who value transparent fees and don’t want to worry about surprise charges

- EU-based senders using SEPA or Sofort for quick, local payments

- Mobile-first users who prefer handling everything from an app

- New users making a one-off transfer are about to take advantage of the free first transaction

Not ideal for

- Those needing a cash pick-up option – it’s digital-only

- Senders moving large sums (over £100k/year) – it’s just not built for that

- Users in countries not supported by Profee – the network’s still growing

- People who get easily frustrated by ID checks – it can be a bit much if you’re in a rush

- Businesses looking for a fully-featured platform – this is more geared towards personal use

Profee Key Features

Profee makes international money transfers simple, fast, and stress-free. Whether sending money to family, paying for services, or handling overseas business transactions, Profee offers a reliable and cost-effective solution. With competitive exchange rates, a seamless mobile app, and robust security measures, every transfer is designed to be smooth, transparent, and hassle-free.

Fast and Reliable Transfers

Speed is one of Profee’s biggest advantages. More than 90% of transfers are completed within minutes, making it an excellent option for urgent payments. Profee supports transactions to over 60 countries, ensuring users can send money to bank cards or accounts quickly and securely without unnecessary delays.

No Hidden Fees and Competitive Exchange Rates

With Profee, what you see is what you get—there are no hidden fees or surprise charges. The first transfer is fee-free, and additional 0% fee promotions are available for certain destinations. Profee also offers competitive exchange rates, helping users maximise the amount their recipient receives. Every transaction clearly displays the exact amount being sent and received before confirmation, ensuring complete transparency.

No Registration Needed to Receive Money

Unlike some services that require recipients to sign up, Profee allows money to be sent directly to a bank card or account without any extra steps. The recipient simply provides their account details, and the funds are deposited instantly. This makes the process as straightforward as possible, eliminating unnecessary registration barriers.

Flexible Payment Methods

Profee provides multiple ways to send money, allowing users to choose the most convenient method. Transfers can be funded using bank cards, Google Pay, Apple Pay, SEPA transfers, and more. For European users, SEPA and Sofort options make it easy to send money across borders, while other local payment methods are supported in select countries.

Profee Account Tiers and Transfer Limits

Profee offers three account levels to suit different transfer needs. The Basic plan is quick to set up and allows transfers of up to €1,000 per year. Users who verify their identity can upgrade to the Plus plan, increasing their limit to €30,000 annually. For those who need even greater flexibility, the Premium plan offers a transfer limit of up to €100,000 per year, subject to proof of income.

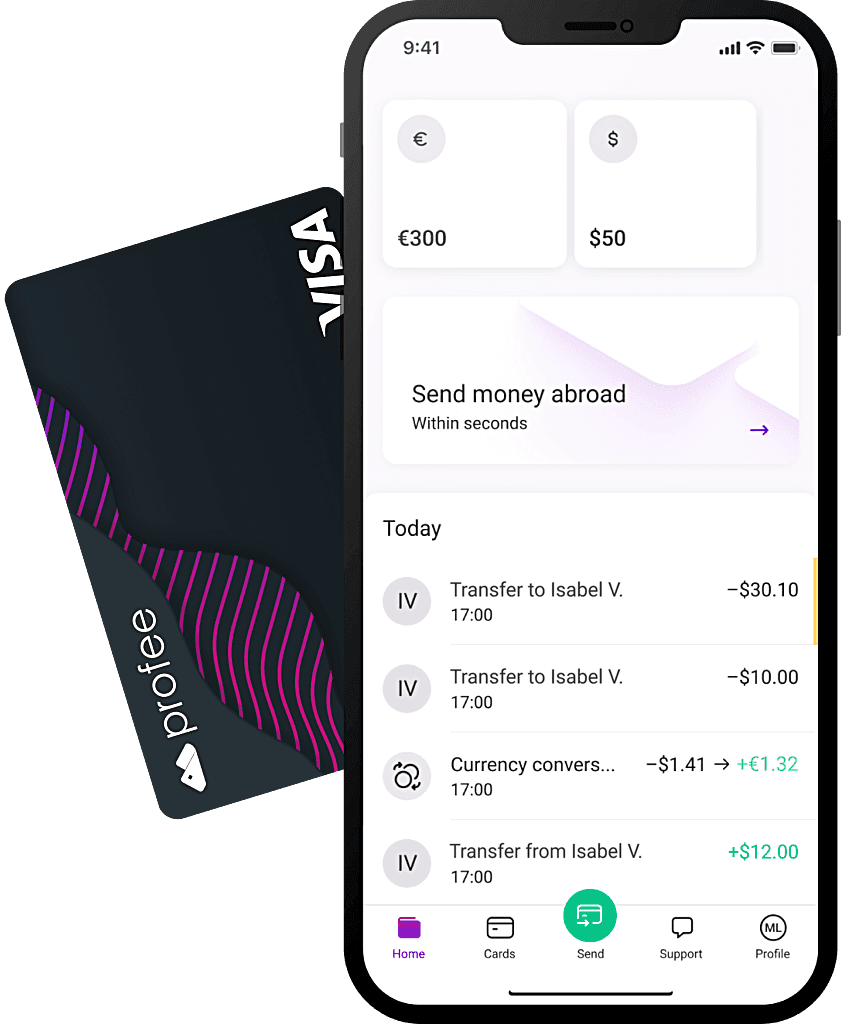

Mobile App

The Profee mobile app makes managing money transfers simple. Users can send and track transactions on the go, receive instant updates on payment status, and save recipient details for faster future transfers. The app also provides access to a full transfer history, making it easy to keep track of past payments.

Dedicated Customer Support

Profee’s customer support team is available seven days a week, ensuring users can get help whenever needed. The team speaks multiple languages and can be contacted through in-app chat, email, or phone, providing responsive and personalised assistance for any questions or issues.

What’s The Transfer Process Like?

Getting Started Is Quick (Almost Too Quick)

Signing up with Profee is honestly one of the fastest onboarding experiences I’ve seen. You can register with just an email and password, or log in via Google or Apple if that’s easier. ID verification kicks in when you start sending, which is standard, but even that’s streamlined. I was up and running in under 10 minutes.

Clean, Minimal Interface

The app and desktop dashboard are both stripped-back and simple. There’s no clutter, and everything you need is right where you expect it:

- Send money

- Track transfers

- View transaction history

- Manage cards and recipients

It doesn’t overwhelm you with financial tools or upsells, which I think will suit people who just want to move money from A to B without fuss.

Making a Transfer

Sending money is very straightforward. You choose the country, enter the amount, pick your delivery method (usually card-to-card or bank account), and pay. That’s it. Before confirming, you’ll get a real-time quote showing the fee and exchange rate, so there are no surprises.

Speed & Notifications

Transfers usually go through within minutes, especially card–to–card transfers. You’ll get a push notification and email confirmation as soon as the transfer is sent and once it’s delivered, which I found quite reassuring.

Managing Your Account

Account settings, transaction history, and support access are all within a tap or two. You can also save regular recipients, which I found handy for repeat transfers. The app’s available in multiple languages too, so it’s worth noting if English isn’t your preferred interface.

How Much Does Profee Cost?

One thing I like about Profee is how upfront they are about pricing. You’ll see the full fee and exchange rate before you send—no hidden extras. And if it’s your first transfer, it’s completely fee-free, which is a nice touch.

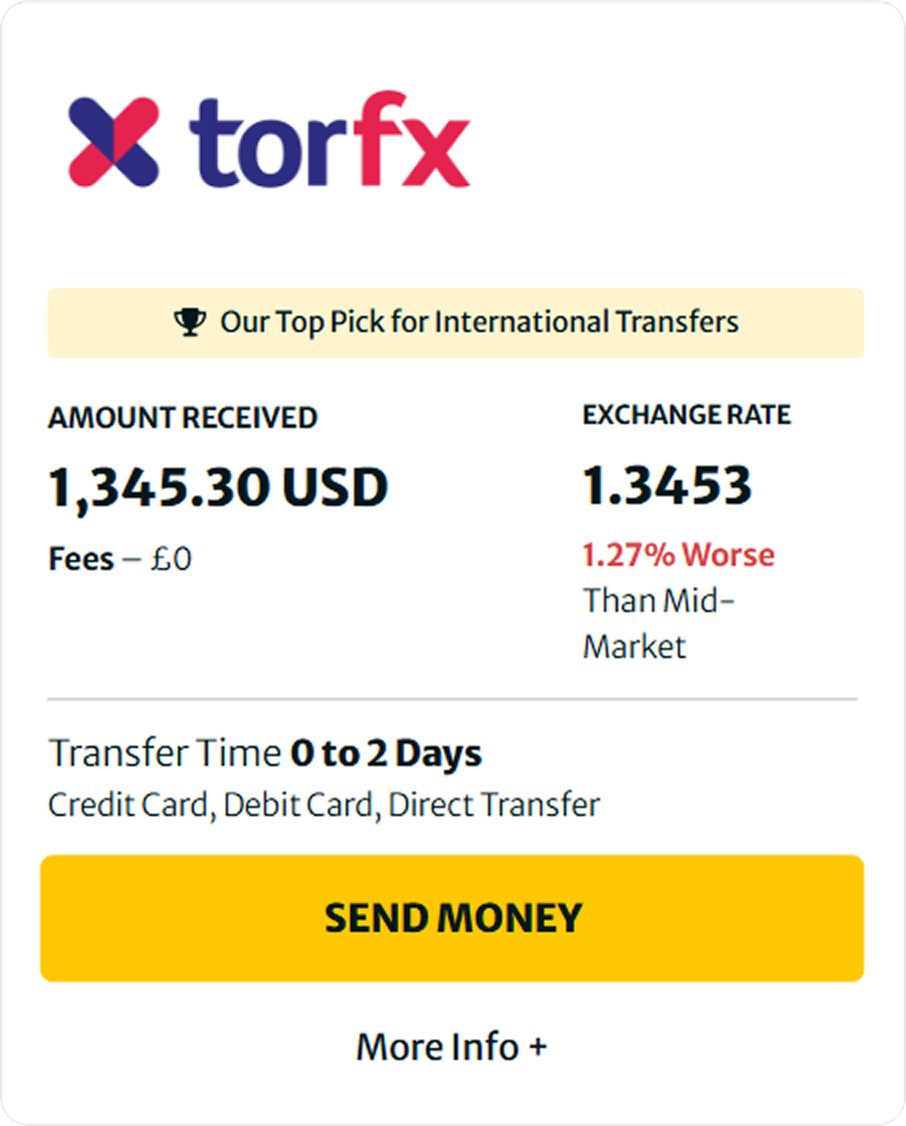

That said, costs vary depending on where you’re sending money, the currency involved, and your chosen delivery method (bank account or card). Fees are baked into the exchange rate, so you see what you pay.

Here’s a general idea of what to expect:

| Transfer Type | Fee | Exchange Rate | Speed |

|---|---|---|---|

| First transfer | Free | Competitive mid-market rate | Usually within minutes |

| Bank transfer (EU to non-EU) | Around 1–2% of the amount | Margin included in rate | Within minutes to 24 hours |

| Card-to-card transfer | Small fixed fee or free | Margin included in the rate | Instant or near-instant |

| SEPA (within the EU) | Often free or low cost | Strong rates | Same-day or next-day |

Customer Support and User Experience

Profee offers 24/7 live chat support, which is a real plus if you need help outside standard working hours. Response times are quick – I tested it a few times, and I was connected with an agent in under a minute each time. The agents were polite and to the point, though the answers sometimes felt scripted rather than tailored.

There’s also email support, but I found it slower. Replying to one query took around 24 hours—not ideal if your transfer is time-sensitive. There’s no phone support, which some users prefer when dealing with large sums or urgent issues.

The Help Centre is decent, with short, clear answers to common questions. It covers things like transfer limits, fees, and ID verification, but it’s quite basic—you might still need live chat for anything more complex.

One thing I noticed: support can’t always override system decisions (like blocked payments or flagged accounts). That can be frustrating if you’re trying to sort something fast.

Overall, I’d say the support is responsive and reliable for everyday questions, but if your transfer hits a snag, resolution can take a bit longer than you’d hope.

Profee Customer Reviews

Profee generally gets strong reviews, and I can see why. Most customers praise the fast transfers, slick app, and decent exchange rates. But dig a little deeper, and there are things to be aware of.

The Good

I’ve noticed a consistent theme: users love how quick and easy it is. On Trustpilot, Profee scores 4.4 out of 5 from over 5,700 reviews, with plenty of people calling it one of the fastest services they’ve used. Transfers can land in minutes, and integrating with Apple Pay is a clear plus.

There’s also good feedback on exchange rates—many say they’re better than what they’ve seen elsewhere. I think that kind of value really adds up for anyone sending money regularly, especially to countries like Russia.

On the app side, it performs well too:

- 4.8/5 on the Apple App Store (479 ratings)

- 4.3/5 on Google Play (9,000+ reviews)

That’s pretty solid and suggests a reliable experience for most.

The Not-So-Good

That said, there’s definitely a flip side. Some users report frustrating delays — transfers marked as “delivered” but funds still missing days (or even weeks) later. Others mention issues with customer support, such as slow replies or no reply at all.

Complaints about hidden fees exist, especially around first-time transfer limits or verification steps. A few people felt the promotional claims didn’t quite match the reality.

One recurring issue is verification. I’ve seen reviews from users who were asked for extra documents mid-transfer, sometimes for both sender and receiver, which they found excessive.

Is Profee Safe To Use?

Profee is a regulated provider with multiple layers of security to protect your money and personal data.

Here’s what stands out from a safety point of view:

- Regulated by EU authorities – Profee is licensed as an Electronic Money Institution by the Central Bank of Cyprus, meaning it’s held to strict financial and operational standards.

- Client funds are safeguarded – Your money is kept separate from Profee’s finances. So, your money wouldn’t be touched even if the company ran into trouble.

- Strong data encryption – They use bank-grade 256-bit encryption to protect your personal and financial information during sign-up and transfers.

- Two-factor authentication (2FA) – You’ll need to verify login attempts and transactions, adding an extra protection layer.

- Ongoing anti-fraud monitoring – Profee automatically flags unusual activity to protect your account from suspicious logins or transfers.

Personally, I feel confident using it – the security setup feels comprehensive without being intrusive. That said, as with any digital finance tool, I’d still recommend using a strong password and keeping your app up to date.

If you’re planning to send larger amounts, it’s worth knowing that they have ID checks and manual reviews in place to prevent fraud before it happens. I think this is a good thing, even if it occasionally slows things down.

Profee Recent Updates and Recognitions

Profee continues enhancing its international money transfer services with exciting new updates, including payment options and destinations.

As of January 2025, PayMaya is now available as a delivery option for transfers to the Philippines. Profee has also recently introduced commission-free transfers to Kenya, with a promo exchange rate for new clients, and expanded delivery options to M-PESA, Airtel, and bank cards.

Profee’s reach grows with new destinations. It now offers transfers to Egypt, Ghana, Jordan, South Africa, and Uganda from the EU and UK. This expansion follows Profee’s rapid growth, which included new transfer options to countries like Azerbaijan, Kyrgyzstan, and Tajikistan.

Recently, Profee has earned multiple awards, including Best International Money Transfer Solution 2024 and Fastest Growing Money Transfer Platform in Europe, reinforcing its reputation for secure, reliable, and fast transfers.

Disclaimer

The content in this article is intended for general information only and should not be considered as financial advice. While we strive to provide accurate and up-to-date details, the information may not apply to your unique financial situation or reflect the latest changes in the industry.

Before making any decisions, such as selecting a money transfer service, it is recommended that you consult with a qualified financial professional who can offer advice tailored to your specific needs. The services mentioned, including Profee, may not be suitable for every individual, and it’s essential to consider all relevant factors, such as fees, exchange rates, and regulatory requirements, before proceeding.

Any reliance on the information provided is at your own risk, and we disclaim any liability for actions taken based on this content. Always review the terms and conditions with the service provider before using them.

FAQs

Yes, Profee is a legitimate and secure option for international money transfers. It operates as a licensed Electronic Money Institution under EU regulations, with security measures like encryption and two-step verification. Profee is generally regarded as reliable, offering transparent fees and competitive exchange rates for transfers to over 60 countries.

Yes, Profee works in the UK and offers a convenient and reliable service for international money transfers. UK users can send funds to over 60 countries using various payment methods, including bank cards, Google Pay, and Apple Pay. Profee provides competitive exchange rates and transparent fees, making it a solid option for UK-based money transfers.

Yes, Profee is safe to use. The platform is regulated as an Electronic Money Institution (EMI) under EU financial regulations. It employs advanced security measures such as encryption, two-factor authentication, and anti-fraud protocols to protect user data and transactions. Additionally, Profee uses PCI DSS certification, ensuring secure handling of payment information.